The crypto market is barely bouncing again from early Friday’s jitters on escalating battle between Israel and Iran.

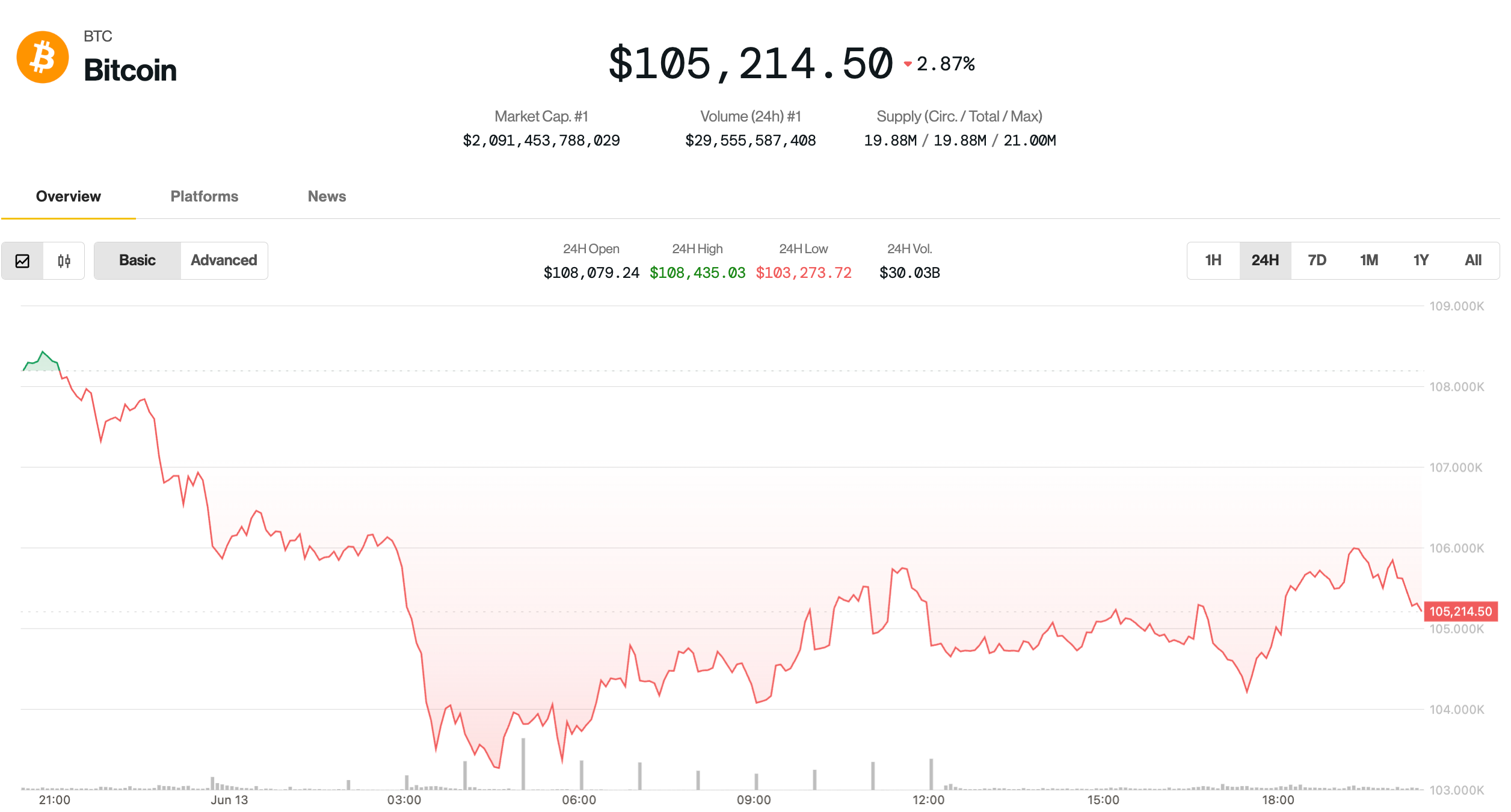

After slumping to the $102,600 mark, bitcoin

rebounded to round $106,000 earlier than fading decrease within the U.S. afternoon hours with stories a couple of contemporary wave of airstrikes concentrating on Iran. The highest cryptocurrency was down 1.6% within the final 24 hours, altering arms at $105,200 and nonetheless lower than 6% shy of its all-time excessive worth.

In the meantime, the CoinDesk 20 — an index of the highest 20 cryptocurrencies by market capitalization, excluding memecoins, stablecoins and alternate cash — has misplaced 4.4% in the identical time period. Tokens equivalent to ether

, avalanche and toncoin have been the toughest hit, slumping between 6% and eight%.

Crypto shares, nonetheless, aren’t doing too scorching. Most equities are within the purple, particularly bitcoin miners MARA Holdings (MARA) and Riot Platforms (RIOT), down 5% and 4% respectively. A notable exception is stablecoin issuer Circle (CIRCL), which continues to be benefiting from the windfall of its latest IPO; the inventory is up 13% at present, with information of retail giants Amazon and Walmart reportedly exploring stablecoins including to the momentum.

Conventional markets don’t appear overwhelmingly involved by the warfare. Whereas gold is up 1.3%, doubtlessly gearing up for brand spanking new all-time highs, the S&P 500 and Nasdaq are solely down 0.4% every.

What’s subsequent for bitcoin?

“Good bounce to date and lack of follow-through decrease,” well-followed crypto dealer Skew stated in a Friday X publish. Market members will doubtless stay cautious by the weekend with BTC tightly correlated with conventional markets amid heightened geopolitical dangers, Skew added.

On the longer timeframe, some analysts see dangers of a deeper pullback.

10x Analysis founder Markus Thielen famous that BTC’s drop under $106,000 interprets to a failed breakout, and merchants ought to anticipate extra favorable setups earlier than dashing to purchase the dip.

He highlighted the $100,000-$101,000 zone as key help, warning {that a} break under may mark a return to the broader consolidation part much like final summer time.

John Glover, chief funding officer at bitcoin lender Ledn, argued that bitcoin entered a corrective part from its report highs that might see the biggest digital asset drop to $88,000-$93,000.

He stated the $90,000 degree may provide a positive entry for opportunistic buyers earlier than BTC resumes its uptrend.

“As soon as this sample has performed out, the following transfer increased to the $130,000 space is anticipated to start,” he stated.