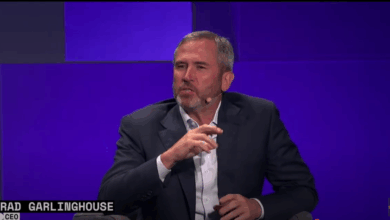

Ripple CEO Brad Garlinghouse believes XRP may quickly take a significant slice of the worldwide funds sector.

In a latest video shared on X, Garlinghouse projected that XRP may seize as a lot as 14% of the amount presently processed by Society for Worldwide Interbank Monetary Telecommunication (SWIFT) throughout the subsequent 5 years.

He argued that the liquidity element of the SWIFT community presents a chance for digital belongings like XRP.

Presently, banks keep management over most liquidity inside SWIFT. Garlinghouse urged that XRP, with its on-demand liquidity capabilities, may function a extra environment friendly various for cross-border transfers.

In accordance with him:

“SWIFT at the moment has two parts: messaging and liquidity. Liquidity is owned by banks. I believe much less concerning the messaging and extra about liquidity. In the event you’re driving all of the liquidity, it’s good for XRP. So, in 5 years, I’d say 14%.”

Regardless of Garlinghouse’s projection, XRP is down by round 4% within the final 24 hours to $2.24 as of press time. The token has declined by over 40% from its January all-time excessive of $3.8, based on CryptoSlate’s knowledge.

Can XRP displace SWIFT?

For many years, SWIFT has served because the spine of world interbank messaging, with greater than 11,000 establishments counting on it to trade monetary transaction knowledge.

In 2022 alone, SWIFT processed a median of 44.8 million messages every day, a determine that business analysts imagine surpassed 50 million in 2024.

But, business gamers imagine that the rising curiosity in blockchain-based options from corporations like Ripple is starting to problem this legacy infrastructure.

Through the years, Ripple has constructed a collection of monetary instruments, together with the XRP token, XRP Ledger, and the Ripple USD stablecoin. These instruments intention to streamline cross-border funds with decrease charges and near-instant settlement instances.

Ripple’s ambitions, nevertheless, haven’t been with out setbacks. The corporate spent years preventing authorized motion from the US Securities and Trade Fee (SEC), which accused it of promoting XRP as an unregistered safety. Notably, this authorized cloud considerably slowed XRP’s adoption by monetary establishments.

Nonetheless, the SEC not too long ago dropped its case towards Ripple, eradicating a major impediment to XRP’s adoption. Market observers imagine this authorized readability may speed up XRP’s development and place it as a reputable various to SWIFT.