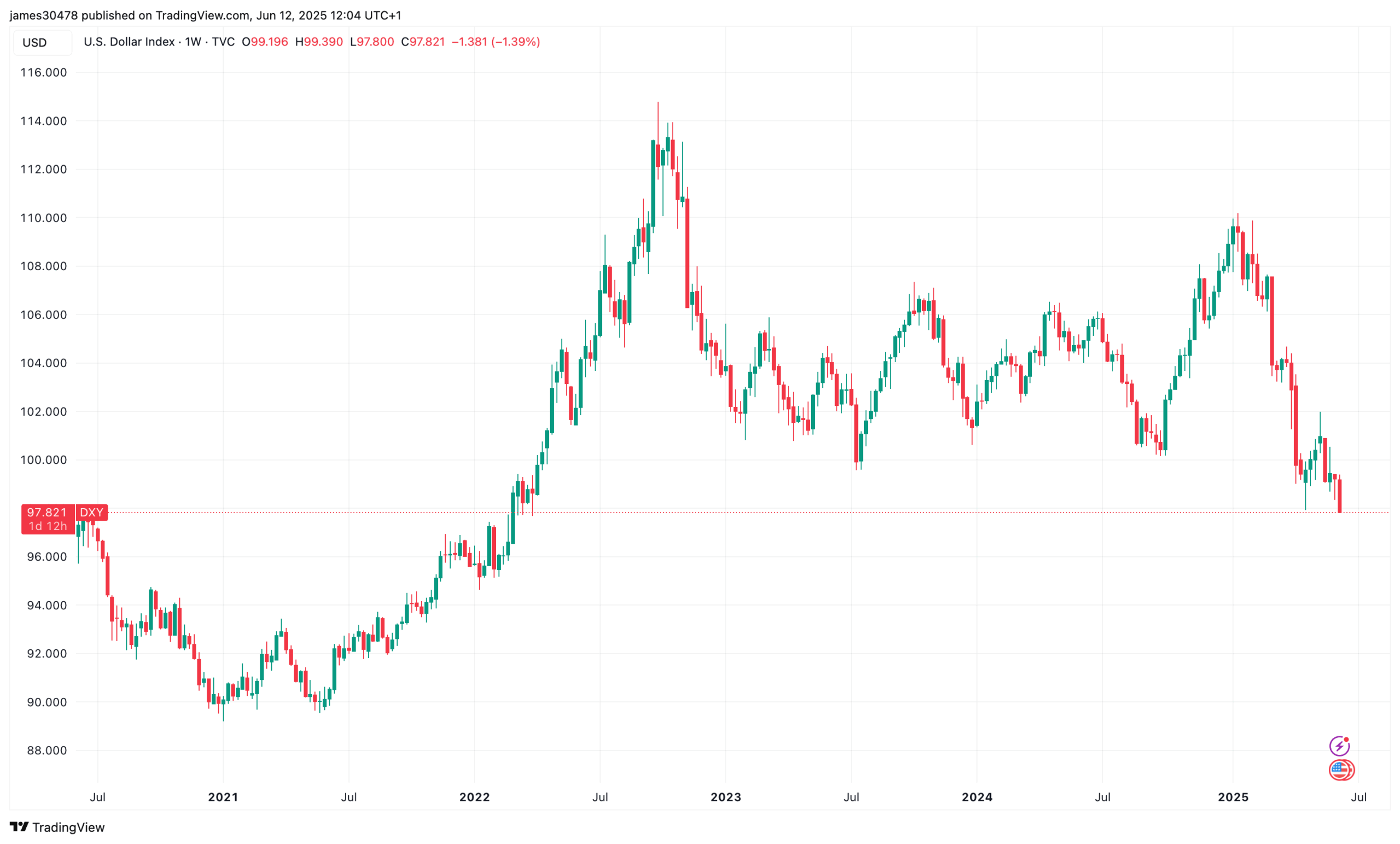

The greenback index (DXY), a measure of the U.S. greenback’s energy in opposition to a basket of main international currencies, dropped under 98 for the primary time since early 2022.

This transfer indicators a notable shift in international forex markets and will create a good atmosphere for threat belongings, particularly cryptocurrencies, like bitcoin

.

Lately, a DXY studying above 100 has usually mirrored greenback dominance and a risk-off sentiment, usually weighing on equities and digital belongings. Conversely, a weakening greenback eases monetary situations, boosts international liquidity, and tends to profit speculative belongings.

A number of elements are contributing to the present decline. US headline inflation got here in at 2.4 % year-over-year, barely under the consensus estimate of two.5 %, strengthening market expectations for a dovish financial coverage shift.

In line with the CME FedWatch Software, markets are actually pricing in a 99.8 % chance of a price minimize on the June Federal Reserve assembly, with the goal vary anticipated to drop to 4.25 to 4.50 %.

Rising narratives round de-dollarization, mixed with coverage uncertainty from the Trump administration’s commerce and tariff insurance policies, have eroded confidence within the greenback, accelerating its decline.

Learn extra: U.S. Greenback to Slide Additional This Summer season, Financial institution of America Warns