Crypto trade Bullish confidentially filed for a U.S. preliminary public providing, the Monetary Instances reported Wednesday, citing individuals aware of the scenario.

The corporate goals to capitalize on renewed enthusiasm for digital belongings pushed by pro-crypto coverage indicators from the Trump administration and follows final week’s IPO of stablecoin issuer Circle (CRCL), whose shares soared 168% on the primary day of buying and selling.

The FT didn’t distinguish between Bullish Change and its guardian, Bullish Group, the Peter Thiel-backed firm that can be the guardian of CoinDesk.

The confidential submitting with the Securities and Change Fee permits Bullish to arrange for a public itemizing whereas conserving monetary particulars non-public for now. Jefferies will function lead underwriter, in accordance with the Monetary Instances.

Bullish beforehand tried to go public in a SPAC deal in 2021. The plan collapsed the next yr amid market volatility. Bullish Change is a Gibraltar regulated buying and selling platform.

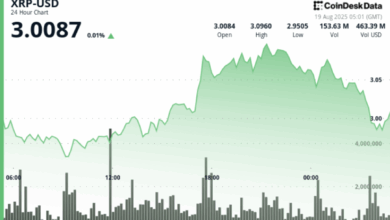

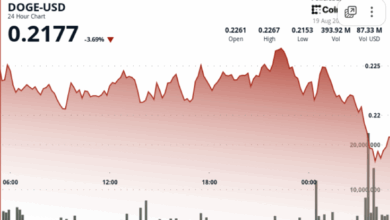

This time, the IPO submitting comes as bitcoin trades round $110,000 and crypto sentiment strengthens amid favorable regulatory tailwinds following the election of U.S. President Donald Trump.

The group is led by CEO Tom Farley, a former president of NYSE Group, and chaired by Brendan Blumer of Block.one. Thiel is a co-founder of PayPal (PYPL) and an early investor in Fb, now Meta (META).

Jefferies declined to remark to the FT. Bullish didn’t reply to the FT and had not responded to a CoinDesk request for remark by publication time.

Learn extra: Bullish World Weighs IPO as Early as This 12 months Amid Crypto Market Optimism: Bloomberg