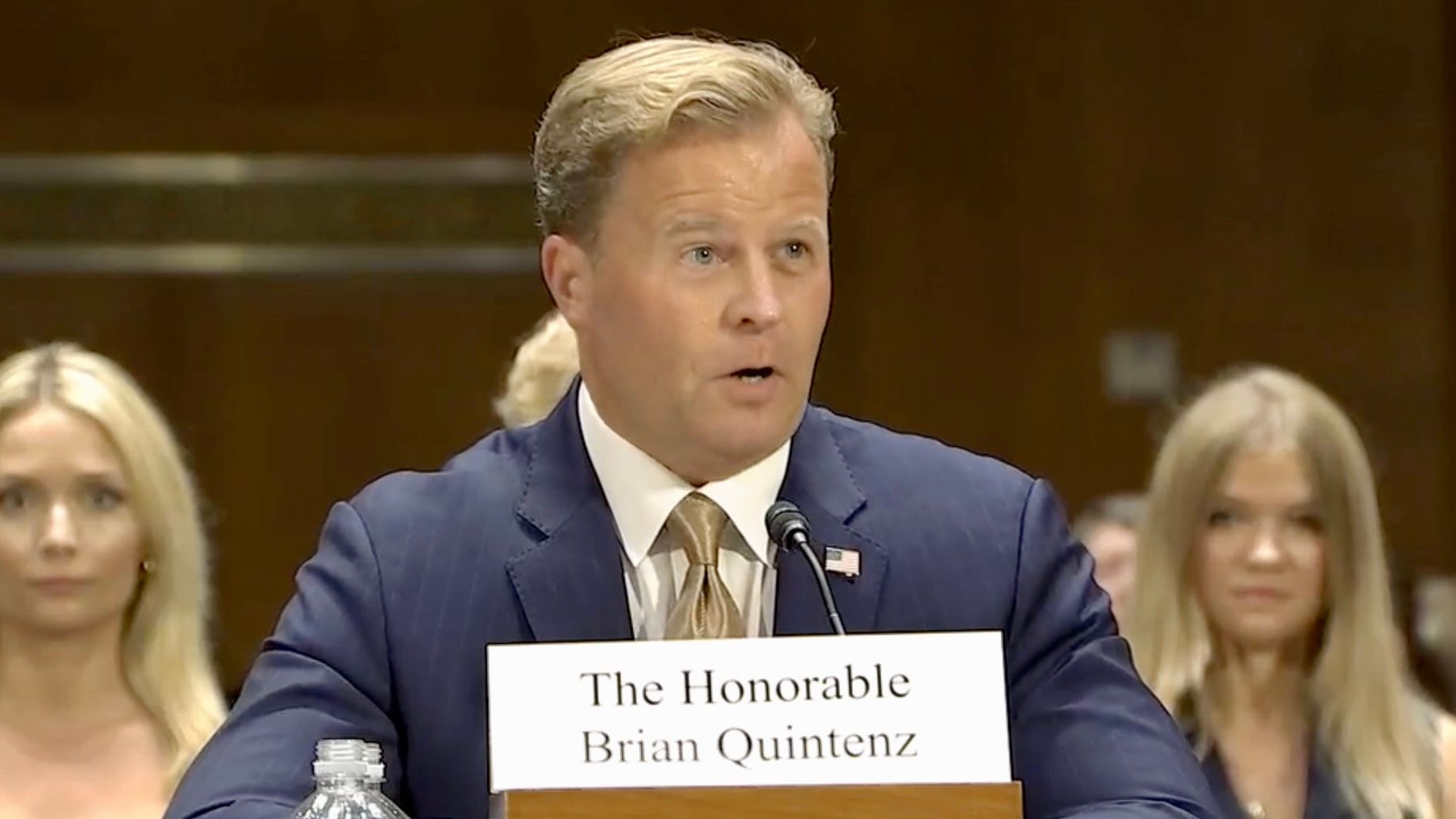

President Donald Trump’s choose to be chairman of the U.S. commodities watchdog, Brian Quintenz, fielded crypto questions greater than every other subject at his Senate affirmation listening to on Tuesday, and he assured the lawmakers that the company can stroll a center floor between unhampered innovation and sturdy client safeguards.

Whilst Quintenz awaits the Senate Agriculture Committee’s vote on whether or not to advance his nomination as chairman of the Commodity Futures Buying and selling Fee, Congress is engaged on market construction laws that might elevate that company because the marquee regulator of U.S. crypto exercise. Quintenz, a former CFTC commissioner, isn’t any stranger to that sector, having served as enterprise capital agency a16z’s head of coverage.

“I’ve all the time seen market construction laws as a chance to be each pro-customer safety and pro-innovation on the identical time,” he informed the senators weighing his nomination, which in the end must be authorized by the general Senate earlier than he can take over the fee. He mentioned the invoice might “present the readability to buildings, entrepreneurs, innovators to develop merchandise” whereas additionally making certain the regulated companies are appropriately defending the customers of these merchandise.

“Congress ought to create an acceptable market regulatory regime to make sure that this expertise’s full promise could be realized, and I’m totally ready to make use of my expertise and experience to help in that effort as effectively in executing any expanded mission ought to laws move into regulation,” Quintenz mentioned, including that he is prepared to work underneath the CFTC’s present powers “to supply readability of how the company’s statutory targets could possibly be efficiently leveraged by means of this expertise.”

Quintenz would be a part of a fee that is being deserted by commissioners. By statute, the CFTC has 5 members — with three from the social gathering in energy — however the members have left or are within the technique of leaving, together with Appearing Chairman Caroline Pham, who mentioned she’s leaving when Quintenz begins work. The lone Democrat, Kristen Johnson, mentioned she’ll depart “later this 12 months,” leaving some uncertainty about her timing. So Quintenz might serve reverse a single Democrat earlier than finally working alone for a time, leaving potential authorized vulnerability for any unilateral insurance policies.

A number of the Democratic senators famous the Trump administration has been systematically stripping regulatory commissions of their Democratic members — described by Senator Raphael Warnock as “political purges” — and requested Quintenz if he would encourage the White Home to fill each side of the roster.

“The president is the pinnacle of the manager, and the president will make his personal selections. Quintenz mentioned. He later added, “I do not inform the president what to do.”

He granted that the company might have extra funding if it is assigned the monumental new process because the regulator of digital commodities spot markets, which would come with transactions of bitcoin

. Quintenz mentioned that new employees could be made extra environment friendly by “a technology-first strategy” that makes the workers extra environment friendly.

Quintenz additionally fielded quite a few questions on the prediction markets, one other space he is had direct expertise with as a board member of Kalshi, which fought a authorized battle with the CFTC over the regulation of occasion contracts. He defended such occasion contracts as an acceptable “hedging device.”

“I consider the Commodity Alternate Act may be very clear concerning the goal of derivatives markets, the aim of danger administration and value discovery, and that occasions [contracts] can serve a perform in that mandate,” he mentioned.

Learn Extra: Trump to Faucet Former CFTC Commissioner, a16z Coverage Head Brian Quintenz for CFTC Head