The Home Agriculture Committee despatched a serious bipartisan message with a 47-6 development of the U.S. crypto market construction invoice on Tuesday, marking the primary of a number of anticipated developments within the development of digital property laws anticipated this week.

A second congressional panel, the Home Monetary Companies Committee, was additionally hashing out a few of the closing particulars on Tuesday on the invoice to arrange digital property market oversight, and on the similar time, the Senate’s laws to control stablecoin issuers was rolling towards a closing vote.

This yr’s effort to lastly set the U.S. stage for crypto buying and selling, often called the Digital Asset Market Readability Act, was the main focus of markups — particular hearings wherein congressional panels think about amendments and put a closing polish on laws earlier than advancing it to the chamber ground. On this case, two Home committees have been contemplating the Readability Act on the similar time on Tuesday, and the agriculture panel completed first.

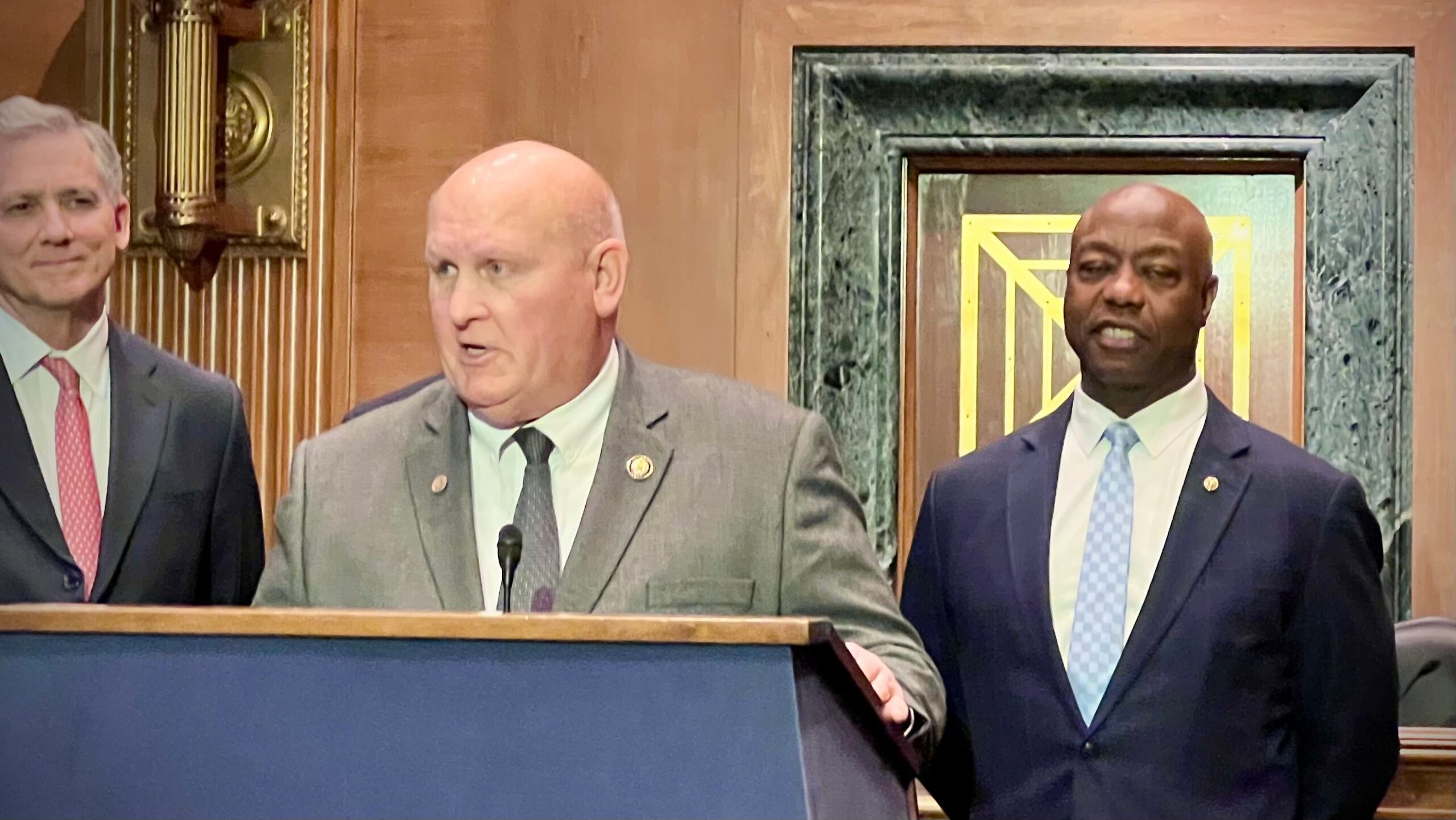

“The Readability Act offers certainty on digital property to market contributors, fills regulatory gaps on the Commodity Futures Buying and selling Fee and the Securities and Alternate Fee, bolsters American innovation and brings wanted buyer protections to digital asset associated actions and intermediaries,” mentioned the agriculture panel’s chairman, Glenn “GT” Thompson, as he opened his committee’s listening to.

The panel’s rating Democrat, Consultant Angie Craig, famous that “this isn’t an ideal invoice,” but additionally mentioned the tens of hundreds of thousands of People utilizing cryptocurrency “will proceed to develop whether or not Congress acts or not, but when we do not act, it should develop with out the buyer protections that retail buyers want and deserve, protections like those who govern different corners of the American monetary system.”

The Home invoice outlines the jurisdictional borders between the 2 U.S. markets regulators and establishes a brand new main function for the CFTC over the buying and selling of digital commodities, which represents the majority of crypto exercise. As a result of the 2 congressional committees every oversees totally different parts of the crypto market — commodities and securities — every has a bit of the related jurisdiction, so the panels’ work to amend the laws should be melded.

Congressional staffers mentioned that the merchandise of profitable markups from every committee would then be mixed right into a unified “committee report” to be thought-about by the broader Home.

The laws has been regularly overhauled proper as much as the markups, with Republicans hoping to maintain sufficient Democrats on board {that a} bipartisan help can affect how a lot the Senate embraces the invoice if it passes the Home. However Democrats within the Home Monetary Companies Committee have been nonetheless assembly to look at factors of the invoice they’ve concern with as lately as late Monday.

Consultant David Scott, one of many Democrats who serves on each committees, expressed the discontent of some in his occasion. “The invoice permits crypto companies to bypass correct oversight and ignore investor protections, as I’ve outlined on a number of events right here and within the finance committee,” he mentioned, arguing that the invoice would not correctly fund the commodities regulator. “The CFTC, although important, will not be designed to supervise retail-facing funding merchandise.”

Scott added, “This can be a reward to the worst actors on this trade.”

Others stay involved that the laws would not straight block senior authorities officers — most notably President Donald Trump — from personally benefiting from crypto enterprise pursuits.

Maxine Waters, the highest Democrat on the Home Monetary Companies Committee, raised comparable issues when she launched an modification Tuesday to the HUD Transparency Act of 2025 that may direct its inspector-general to analyze a suggestion that the Division of Housing and City Improvement would possibly consider crypto or stablecoins for funds.

“Sadly, Trump and his administration are attempting to drive crypto down the throats of individuals dwelling in HUD-assisted housing,” she mentioned. “I for one would need to know if HUD is utilizing Trump’s stablecoin, how they select the stablecoin and what charges are being paid into the president’s pocket.”

GENIUS Act

Whereas the Home strikes ahead on the Readability Act, the Senate is nearing a possible closing vote this week on the Guiding and Establishing Nationwide Innovation for U.S. Stablecoins of 2025″ (GENIUS) Act, which might erect guardrails for the issuance of U.S. stablecoins, the dollar-based tokens that underpin a large swath of crypto buying and selling.

Majority Chief John Thune, the Senate’s prime Republican who has lately joined the hassle to push ahead the stablecoin laws, made a procedural transfer on Monday to quickly advance to a closing vote. Business insiders are getting ready for a vote as quickly as Wednesday.

Jaret Seiberg, a coverage analyst at TD Cowen, mentioned in a word to purchasers that Thune’s transfer meant a “restrict what amendments might be thought-about earlier than a closing vote on the package deal,” together with making it troublesome for the backers of unrelated credit-card laws to make use of the stablecoin invoice as leverage to drive consideration of their very own effort. That was one of many closing potential roadblocks to Senate development on the invoice, which has already drawn sturdy bipartisan votes because it moved by way of the method in that chamber of Congress.

The laws’s sponsor, Senator Invoice Hagerty, had made it clear that the invoice faces a really tight window for adoption this yr, contemplating what else is on the Senate’s plate. The GENIUS Act was on the Senate’s ground agenda for Tuesday, with a 2:30 p.m. modification deadline.

If the GENIUS Act passes the Senate, it’s going to head to the Home, the place an analogous stablecoin invoice already awaits, having cleared its committee hurdles. At that time, lawmakers should determine their technique on how one can proceed, whether or not to incorporate the stablecoin matter alongside the market construction invoice as a single package deal, whether or not the Home can simply take up the Senate’s invoice as written or whether or not the Home will search to hash out its personal model.