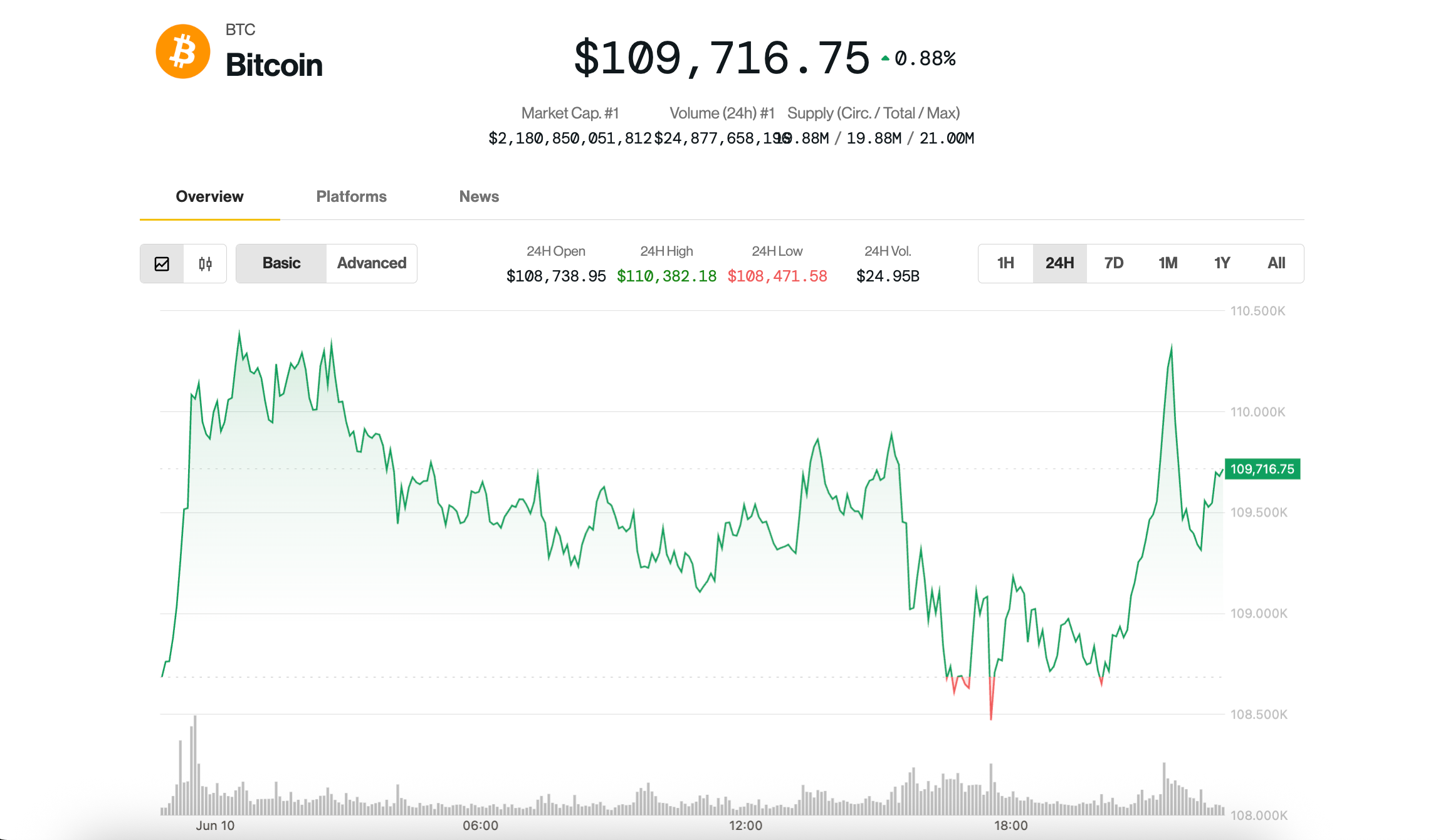

Bitcoin recaptured the $110,000 degree for the second consecutive day, maybe dragged greater by even bigger positive factors amongst altcoins.

Up 0.9% greater than 1% within the final 24 hours, bitcoin was buying and selling simply above $110,000 shortly after the shut of U.S. inventory markets Tuesday. The CoinDesk 20 — an index of the highest 20 cryptocurrencies by market capitalization, excluding stablecoins, change cash and memecoins — has risen 3.3% in the identical time period, principally due to ether

, solana , chainlink all gaining 5%-7%.

The standout performances, nonetheless, have been placed on by uniswap

and aave , which soared a whooping 24% and 13%, respectively. The transfer was prompted by optimistic feedback on the subject of DeFi by Securities and Change Fee (SEC) Chair Paul Atkins on Monday.

Issues have remained comparatively calm on the equities entrance, with most crypto shares flat on the day. A notable exception is Semler Scientific (SMLR), a agency that goals to comply with Technique’s (MSTR) playbook and vacuum up as a lot bitcoin as potential. Shares fell one other 10% right this moment, with the inventory now buying and selling for lower than the worth of the bitcoin on its stability sheet.

Regardless of the day’s positive factors, positioning throughout crypto markets nonetheless displays a largely defensive tone.

“Funding charges and different leverage proxies level towards a steadily cautious sentiment out there,” Vetle Lunde, head of analysis at K33 Analysis, identified in a Tuesday report. “The broad danger urge for food is remarkably weak, on condition that BTC is buying and selling near former all-time highs.”

Binance’s BTC perpetual swaps posted unfavourable funding charges on a number of days final week, with the common annualized funding charge now sitting at simply 1.3% — a degree usually related to native market bottoms quite than tops, Lunde famous.

“Bitcoin doesn’t normally peak in environments with unfavourable funding charges,” he wrote, including that previous situations of such positioning have extra typically preceded rallies than corrections.

Flows into leveraged bitcoin ETFs paint the same image. The ProShares 2x Bitcoin ETF (BITX) at present holds publicity equal to 52,435 BTC — properly under its December 2023 peak of 76,755 BTC — and inflows stay muted. This defensive positioning, based on Lunde, leaves room for a possible “wholesome rally” in BTC to develop.

Nonetheless, not all market watchers are satisfied that the present value motion marks the beginning of a sustainable breakout.

“Is that this a real breakout that may proceed? In my opinion, in all probability not,” mentioned Kirill Kretov, senior automation professional at CoinPanel. “Extra seemingly, it’s a part of the identical volatility cycle the place we see a rally now, adopted by a pointy drop triggered by a unfavourable announcement or another narrative shift.”

In keeping with Kretov, the present setting favors skilled merchants who can navigate volatility-driven market construction. Technically, he sees BTC’s subsequent key assist ranges at $105,000 and $100,000 — zones that might be examined if promoting strain returns.