Key takeaways:

-

Bitcoin’s p.c provide on exchanges has dropped beneath 11% for the primary time since 2018.

-

Institutional adoption is accelerating BTC withdrawals from public exchanges.

-

Belief in centralized platforms is shaky post-FTX.

Bitcoin’s (BTC) p.c provide on exchanges has dropped to close seven-year lows, falling beneath 11% for the primary time since March 2018, in accordance with Glassnode information.

The height occurred round March 2020, when over 17.2% of the BTC provide was held on exchanges. Since then, over 6% of the full provide, or roughly 1.26 million BTC, has been withdrawn from trade wallets.

Let’s look at the important thing causes behind Bitcoin’s rising withdrawals from crypto exchanges.

Bitcoin’s HODLing rises to a two-year excessive

Bitcoin traders are holding onto their cash on the highest stage in over two years, in accordance with the newest Change Flows to Community Exercise Ratio chart by CryptoQuant.

The ratio, measuring the amount of BTC flowing to exchanges relative to onchain community exercise, has fallen to its lowest studying since early 2023, signaling subdued trade deposits regardless of rising costs.

As of early June 2025, the 30-day transferring common of the ratio sits close to 1.2, nicely beneath its 365-day common and approaching -1 customary deviation.

Traditionally, such low ranges have marked intervals of robust conviction amongst long-term Bitcoin holders, with traders preferring chilly storage to buying and selling.

Associated: Bitcoin eyes $115K by July, however robust US job information to threaten rally: Analysts

This reduces accessible provide, with fewer cash probably up on the market at the same time as Bitcoin nears all-time highs.

Institutional custodians changing crypto exchanges

The rise of institutional custody options is one other main issue behind Bitcoin’s lowering provide throughout exchanges.

As an alternative of public exchanges, giant monetary establishments like BlackRock, Constancy, and Franklin Templeton desire third-party custody platforms.

Coinbase Prime, for instance, reported over $212 billion in belongings underneath custody in Q1 2025, pushed by “inflows from ETF issuers, firms, and excessive web price people.”

The Coinbase crypto trade, then again, witnessed over $500 million price of BTC outflows in the identical quarter.

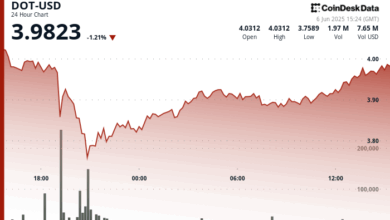

The outflows have continued into the second quarter, together with 761 million price of withdrawals witnessed on June 5.

ETFs have attracted a big portion of those Bitcoin to their coffers.

The web price of belongings managed throughout spot Bitcoin ETFs was $44.54 billion as of June 5, up from round $1 billion at their launch in January final 12 months.

Supporting this pattern, a 2025 survey by Coinbase and EY-Parthenon discovered that 83% of institutional traders plan to extend their crypto publicity, with practically 60% allocating over 5% of their AUM to digital belongings.

About 61 public firms already management over 3% of the full Bitcoin provide of 21 million tokens, in accordance with Commonplace Chartered.

Belief in exchanges dwindles post-FTX collapse

Following the collapse of FTX in late 2022, Bitcoin skilled a dramatic shift in trade flows, as seen within the Glassnode chart.

The web switch quantity (purple bars) reveals sustained outflows via early to mid-2023, marking one of many largest withdrawal intervals in Bitcoin’s historical past.

From November 2022 to Might 2023, weekly outflows repeatedly exceeded 10,000 BTC, totaling nicely over 200,000 BTC withdrawn from centralized exchanges.

This implies that belief in crypto exchanges has declined for the reason that FTX collapse, accelerating Bitcoin withdrawals to self-custody and different platforms for buying and selling.

This text doesn’t comprise funding recommendation or suggestions. Each funding and buying and selling transfer includes danger, and readers ought to conduct their very own analysis when making a call.