Secure, a crypto self-custody agency beforehand often known as Gnosis Secure, has launched a subsidiary, Secure Labs, to construct enterprise-grade self-custody options.

In line with a June 5 announcement shared with Cointelegraph, Secure Labs is a business subsidiary wholly owned by Secure. It’ll concentrate on constructing institutional merchandise utilizing Secure Sensible Accounts, a modular sensible contract-based pockets system.

“The way forward for Web3 will depend on giving customers absolute confidence of their digital sovereignty,” mentioned Lukas Schor, co-founder of Secure and president of the Secure Ecosystem Basis. “With Secure Labs, we’re constructing the infrastructure to make that attainable — enterprise-grade, safe and intuitive by design.”

Secure Labs might be led by Rahul Rumalla, previously the corporate’s chief product officer. Rumalla has greater than 15 years of expertise in engineering and product management, having based Web3 startups Paperchain and Otterspace, and beforehand served as director of engineering at SoundCloud.

Rumalla advised Cointelegraph that the agency’s goal is “any enterprise that should maintain or expose clients to onchain worth.” He additionally mentioned that “loads of enterprises and establishments are already utilizing us and have been doing so for years now.”

He added that the brand new unit would permit the corporate to “construct a extra opinionated product” for shoppers.

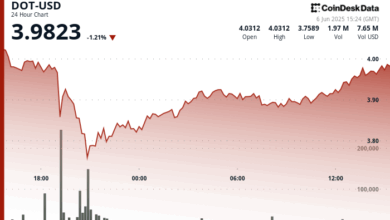

In line with Rumalla, Secure presently secures $60 billion in property, powers 4% of all Ethereum transactions, and anchors roughly 10% of the Ethereum Digital Machine smart-account market.

Associated: ‘If not self-custody, then why crypto?’ — Ledger CEO

The significance of self-custody

Self-custody refers to customers sustaining management of their non-public keys, a essential part for safeguarding crypto property with out counting on third-party custodians.

To boost their security, institutional traders typically additionally depend on multisignature setups. These require a number of non-public keys to authorize a transaction, somewhat than only one.

Nonetheless, many multisignature setups require so-called blind signing with {hardware} wallets. Blind signing refers to approving a transaction on a {hardware} pockets with out with the ability to absolutely confirm its particulars on the system’s display screen.

It’s because such transactions typically leverage advanced sensible contract logic or customized knowledge codecs that the {hardware} pockets doesn’t natively help. Which means the person must belief the transaction data displayed by their internet-connected and weak system — often a pc — when approving a transaction.

This has led to disastrous penalties previously. One current instance is February’s huge $1.4 billion Bybit hack, which was attributed to blind signing within the Secure suite.

The custody supplier additionally launched a autopsy replace explaining the foundation reason for the current Bybit hack — a compromised developer machine.

Binance co-founder Changpeng “CZ” Zhao criticized the replace. He claimed that the corporate brushed apart some points concerned and didn’t reply necessary questions raised by the hack.

Associated: Find out how to retailer crypto property in a self-custodial pockets

Blind signing continues to be concerned

Secure’s upcoming product is predicated on its “Secure Sensible Accounts,” a modular smart-contract pockets constructed on the agency’s infrastructure. It permits for multisignature administration, however nonetheless wants blind signing for a lot of onchain interactions.

To handle this subject, it will possible require multisignature resolution builders, equivalent to Secure, to collaborate with {hardware} pockets producers like Ledger and Trezor. Ledger CEO Pascal Gauthier beforehand acknowledged the difficulty.

“Blind signing is one thing that everyone does within the trade, but it surely’s loopy as a result of it’s like signing clean checks on-line,” he mentioned.

Journal: Lazarus Group’s favourite exploit revealed — Crypto hacks evaluation