Key takeaways:

-

XRP onchain knowledge and chart setups converge on the $3 goal.

-

Spot taker CVD has flipped optimistic, suggesting confidence amongst consumers.

-

XRP/BTC hints at a possible 70% rally.

XRP (XRP) is flashing a number of technical and onchain indicators, suggesting {that a} rally to $3 is feasible this month. Listed here are a number of charts making the case for a near-term breakout.

XRP falling wedge sample targets $3.20

The weekly chart exhibits XRP value buying and selling with a falling wedge sample, with the worth dealing with resistance from the sample’s higher trendline at $2.43.

A weekly shut above this space will clear that path for XRP’s rise towards the wedge’s goal at $3.20, representing a forty five% improve from the present value.

Falling wedges are sometimes bullish reversal patterns, and XRP’s continued consolidation inside the sample’s trendlines means that the upside isn’t over. Worth can be using above all the foremost shifting averages, a key development sign.

Ascending XRP value triangle targets $3.50

Information from Cointelegraph Markets Professional and TradingView exhibits XRP buying and selling inside an ascending triangle within the every day timeframe, as proven within the chart beneath.

The worth wants to shut above the resistance line of the prevailing chart sample at $2.60 to proceed the upward trajectory, with a measured goal of $3.50.

Such a transfer would convey the entire positive factors to 60% from the present degree.

The triangle fashioned after a 70% restoration to $2.65 from a multimonth low of $1.61 reached on April 7. This means that XRP value could possibly be coiling earlier than resuming its uptrend.

As Cointelegraph reported, XRP should maintain above the $2 psychological degree to keep away from a deeper drop towards the subsequent probably assist at $1.70. The worth has held above this degree since April 11, suggesting that the bullish construction stays intact.

XRP/BTC bullish divergence

XRP’s upside case is supported by a rising bullish divergence between its XRP/BTC pair and the relative power index (RSI).

The month-to-month chart beneath exhibits that the XRP/USD pair dropped between 2019 and 2025, forming decrease highs.

However, in the identical interval, its month-to-month RSI ascended to 67 from 41, forming larger highs, as proven within the chart beneath.

A divergence between falling costs and a rising RSI normally signifies weak point within the prevailing downtrend, prompting merchants to purchase extra on the dips and leading to vendor exhaustion.

Associated: Is XRP value going to crash once more?

The chart above additionally reveals that XRP/BTC faces vital resistance between 0.00002530 BTC and 0.00003375 BTC, aligning with the 100 easy shifting common.

A break above this space may see the XRP/BTC pair proceed its rise, fueled by positive factors in XRP/USD value.

Zooming in, an asymmetrical triangle setup on the daily-candle chart signifies a possible breakout towards 0.00003609 BTC, about 71% above present ranges, by June. The upside goal aligns with the January- February 2025 ranges round $3.

Constructive spot taker CVD

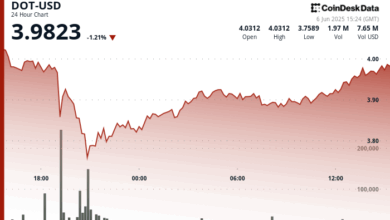

XRP value continues to search out assist amongst merchants, with consumers staying dominant regardless of the market falling 17% from its Might 12 native highs of $2.65.

Analyzing the 90-day spot taker cumulative quantity delta (CVD) reveals that buy-orders (taker purchase) have turn into dominant once more. CVD measures the distinction between purchase and promote quantity over a three-month interval.

In different phrases, extra purchase orders are being positioned out there than promote orders. This means sustained demand regardless of the latest pullback and customarily indicators that the worth could get well from present ranges.

Till mid-March, sell-side stress dominated the order e-book, with the XRP/USD pair hitting multimonth lows of $1.61 in early April.

Impartial circumstances then prevailed till purchaser dominance reentered on Might 19.

Constructive CVD additionally signifies optimism amongst merchants, as they’re actively accumulating the asset, doubtlessly anticipating additional value will increase.

If the CVD stays inexperienced, it means consumers will not be backing down, which may set the stage for an additional wave of upward motion, as seen in historic rallies.

This text doesn’t include funding recommendation or suggestions. Each funding and buying and selling transfer entails threat, and readers ought to conduct their very own analysis when making a choice.