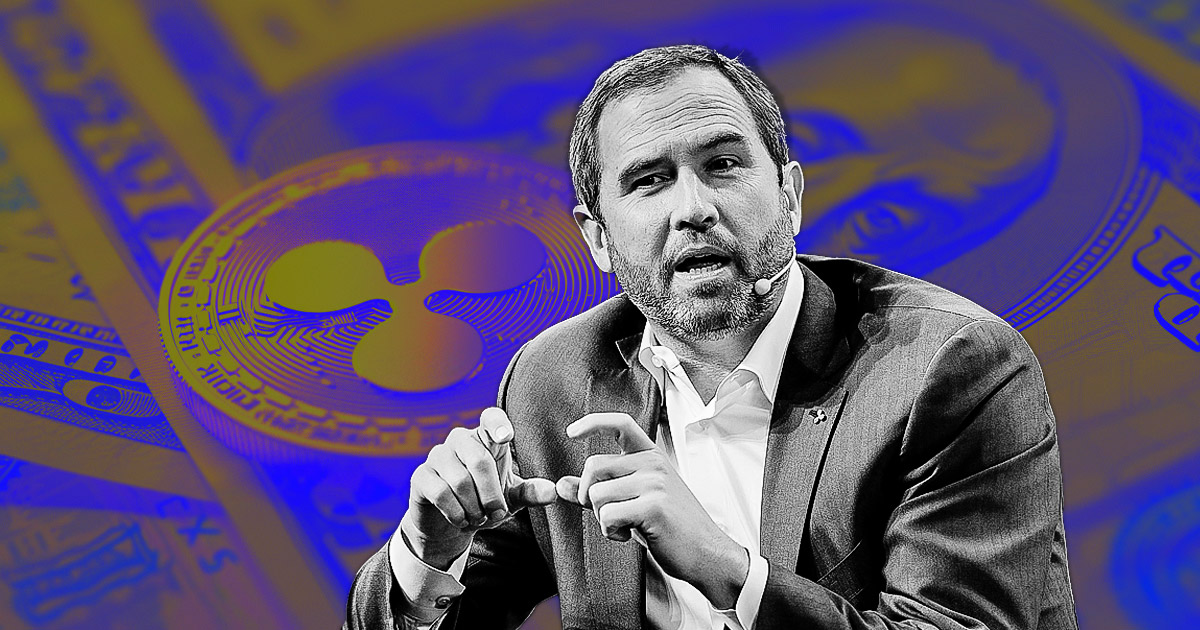

Ripple CEO Brad Garlinghouse stated the corporate by no means tried to purchase Circle, countering reviews of a multibillion-dollar takeover bid.

Georgetown Regulation professor Chris Brummer stated Garlinghouse advised him throughout an on-stage interview at a personal occasion in Las Vegas on June 1 that Ripple “by no means pursued an acquisition of Circle” and the subject was not into consideration.

Brummer added that Garlinghouse “wished the corporate nicely” however seen Circle’s enterprise as exterior Ripple’s present plans.

Rumored bid

Experiences surfaced on April 30 that Ripple had supplied between $4 billion and $5 billion for Circle, citing unnamed sources who stated Circle rejected the worth as too low and left open the potential of future talks.

Circle has been getting ready for an preliminary public providing since submitting registration paperwork with the US Securities and Alternate Fee (SEC) on April 1, and its management has not commented publicly on valuation or timing.

Garlinghouse’s assertion in Las Vegas is the primary direct rebuttal from Ripple’s senior administration to the takeover rumor.

Throughout the identical session, Garlinghouse outlined plans to place Ripple’s upcoming RLUSD stablecoin as on-ledger collateral for transactions settled on the XRP Ledger.

Broader technique

He framed RLUSD and the agency’s latest acquisition of prime-brokerage platform Hidden Street as steps towards constructing market infrastructure that hyperlinks conventional finance with tokenized property.

Garlinghouse stated Ripple is working with officers within the United Arab Emirates on real-estate tokenization pilots and urged crypto corporations to keep away from public disputes that harm trade credibility, referencing Ripple’s donation of the “Satoshi cranium” artifact as a gesture of inter-network diplomacy.

Garlinghouse additionally recounted previous conferences with the SEC, describing variations in employees engagement through the company’s long-running litigation towards Ripple.

Brummer wrote that the feedback highlighted the private stakes concerned in regulatory battles and the hybrid future Ripple envisions, the place tokenized property, stablecoins, and banks function on interconnected rails.