NEAR Protocol has been caught within the crosscurrents of worldwide financial uncertainty, with its value motion reflecting broader market turbulence as traders navigate advanced geopolitical developments.

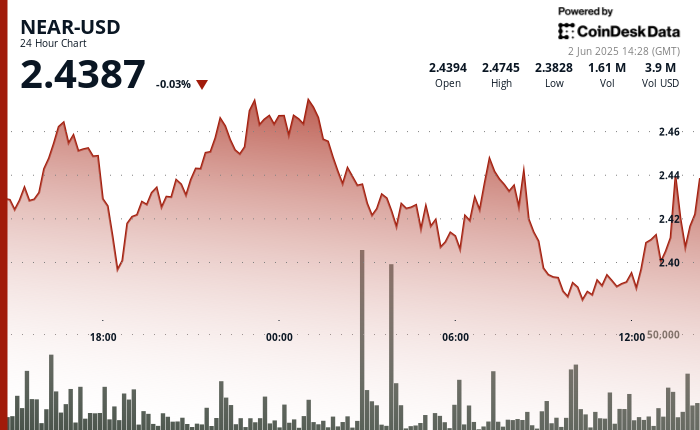

The cryptocurrency skilled important volatility over the previous 24 hours, establishing a buying and selling vary between $2.38 and $2.49.

The token’s efficiency mirrors the stress in conventional markets, the place escalating US-China commerce disputes threaten world provide chains and create explicit uncertainty for technology-focused belongings like NEAR.

In the meantime, the European Central Financial institution’s indicators towards potential charge cuts amid slowing inflation present a blended outlook for digital belongings as financial coverage shifts throughout main economies.

Including to the market complexity, intensifying Center East conflicts have triggered new sanctions affecting oil costs, additional contributing to the market volatility mirrored in NEAR’s value fluctuations.

Technical evaluation

- Excessive-volume help zone shaped round $2.38-$2.40, with constant purchaser intervention in the course of the 09:00-11:00 timeframe on above-average quantity exceeding 2.5 million items.

- Descending resistance trendline established after reaching $2.481 at 01:00, indicating persistent bearish momentum regardless of restoration makes an attempt.

- Bullish surge from $2.399 to $2.439 (1.67% acquire) within the last hour, with a notable resistance breakthrough at $2.420 adopted by consolidation close to $2.435.

- Sharp pullback to $2.399 at 14:00 earlier than recovering to $2.414, suggesting robust shopping for curiosity on the $2.400 help degree.

- Worth stabilization inside a narrower vary signifies potential continuation of upward motion if quantity help stays robust.

Disclaimer: Elements of this text had been created utilizing AI.