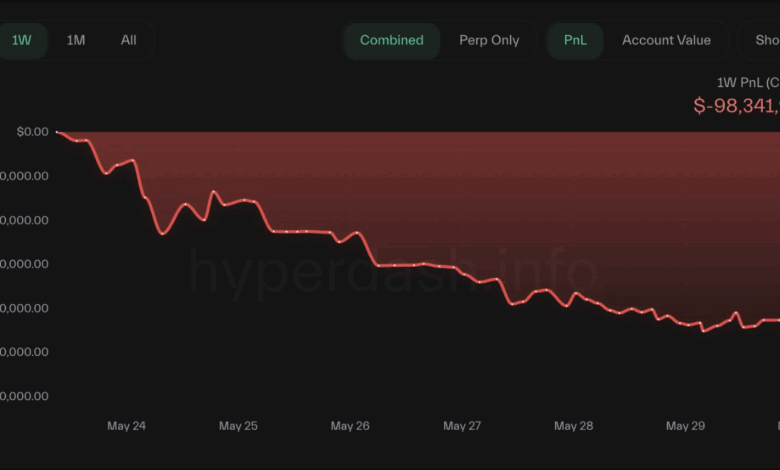

Derivatives dealer James Wynn emerged out of the woodworks just a few weeks in the past, flaunting 9-figure bitcoin positions on HyperLiquid as he went on a seemingly undefeatable run that culminated in round $100 million value of revenue.

However that run, as is usually the case with highly-leveraged crypto by-product buying and selling, got here to a stunning finish — Wynn liquidated his total account regardless of BTC solely transferring by a few %.

“I’ve determined to provide perp buying and selling a break,” Wynn wrote on X after the ultimate blow up. “Its been a enjoyable experience. Roughly $4 million into $100 million after which again all the way down to a complete account lack of $17.5 million.”

Wynn’s story is nothing new. In 2021, for example, the trade noticed the general public rise of Alex Wice — a poker participant turned derivatives dealer — that additionally misplaced $100 million after making enormous bets with leverage. And even in 2017, within the BitMEX trollbox days, pseudonymous figures like SteveS and TheBoot used to boast about their 10s of thousands and thousands in revenue and loss earlier than perpetually fading into obscurity.

The issue with crypto derivatives

Cryptocurrency derivatives might be an extremely great tool; if a dealer holds 500 BTC ($52 million) and believes the market will go down, they will hedge their place by going quick — decreasing publicity with out having to promote their spot belongings, which in itself may trigger slippage or entrance operating.

An array of delta impartial methods can be employed just like the basic foundation commerce that turned widespread amongst institutional merchants on the bitcoin CME futures market, which contain concurrently going lengthy and quick to reap the funding price as a yield.

However points start to type when crypto merchants, nearly all of whom are inexperienced retail merchants, use platforms that supply as much as 100x leverage.

Think about a newcomer had $5,000 in buying and selling capital, positive, they might make just a few intraday trades and make $50 or $100 per commerce, but when they used 100x they might make $50,000 per 10% transfer. That is the slippery slope of gambling-induced emotional buying and selling that many fall into.

Knowledge from NewTrading exhibits that simply 3% of day merchants make a revenue and 1% achieve this constantly. And the sport turns into even more durable when, on this case, merchants are opening positions value lots of of thousands and thousands of {dollars}.

James Wynn exists the on line casino

James Wynn’s downfall got here partially on account of his incapability to take care of the emotional swings of buying and selling, but additionally the sheer dimension of his positions.

Wynn would typically publish about getting partially liquidated and re-opening the place at a worse break-even level. That is indicative of a dealer out of his depth by means of over-leverage. As Wynn utilized in some instances 40x leverage, his liquidation level left no margin for error, this meant that astute merchants or buying and selling corporations may hunt his liquidation level and pressure him into an impulsive commerce.

HyperLiquid is a comparatively liquid derivatives venue, it has thousands and thousands in market depth inside 1% of an asset’s value nevertheless it doesn’t have lots of of million, which was required to soak up Wynn’s leveraged positions.

In actuality, Wynn’s commerce thesis was primarily based across the Bitcoin Las Vegas occasion and any potential bulletins that might elevate bitcoin above a brand new report excessive. If this got here into fruition, Wynn would have had lots of of thousands and thousands in unrealized revenue, however sadly in his case, bitcoin started to stoop in the course of the convention as speeches from Michael Saylor and Ross Ulbricht did not spark any upside momentum.

The shortage of volatility and Wynn’s insatiable urge for food to maintain betting led to him getting chopped out of the market. His losses turned so notable that one dealer determined to counter commerce each place by going quick similtaneously Wynn went lengthy, this dealer made $17 million, in line with Lookonchain.

Because the solar lastly set on Wynn’s derivatives journey he introduced he was “going again to the trenches” to commerce meme cash, after all.