The Ethereum blockchain has but to see a major enhance in exercise regardless of successive upgrades, funding financial institution JPMorgan (JPM) mentioned in a analysis report.

“Neither the variety of day by day transactions nor the variety of energetic addresses noticed a fabric enhance submit current upgrades,” analysts led by Nikolaos Panigirtzoglou wrote within the Wednesday report.

Nonetheless, complete worth locked (TVL) on Ethereum elevated between the Dencun improve in March 2024 and Pectra earlier this month, the financial institution famous, presumably as a consequence of elevated lending and borrowing on decentralized exchanges (DEXs), however the enhance appears decrease in greenback phrases than within the blockchain’s ether

token.

Ethereum activated the Pectra improve on Might 7. The replace goals to streamline staking, improve pockets performance and enhance total effectivity.

Pectra makes the ETH token and Ethereum itself extra interesting to establishments, the financial institution mentioned. It distinguishes the community from rivals, however the upgrades have not boosted exercise in a significant manner.

The financial institution famous that following the Dencun improve, each common and complete charges fell, partially due to a shift towards layer 2 chains.

Ether’s circulating provide additionally elevated after Dencun, which raised issues in regards to the crypto “changing into an inflationary asset amid subdued transaction exercise,” JPMorgan mentioned.

Futures positioning means that establishments performed a big position within the current rally in ether, the report added. Ether has risen greater than 45% up to now month, CoinDesk knowledge present.

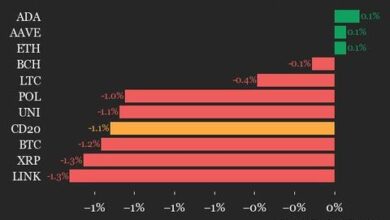

Learn extra: Ether Solely Crypto Main in Inexperienced, XRP Muted After Mammoth Treasury Plans