By Omkar Godbole (All occasions ET except indicated in any other case)

Bitcoin

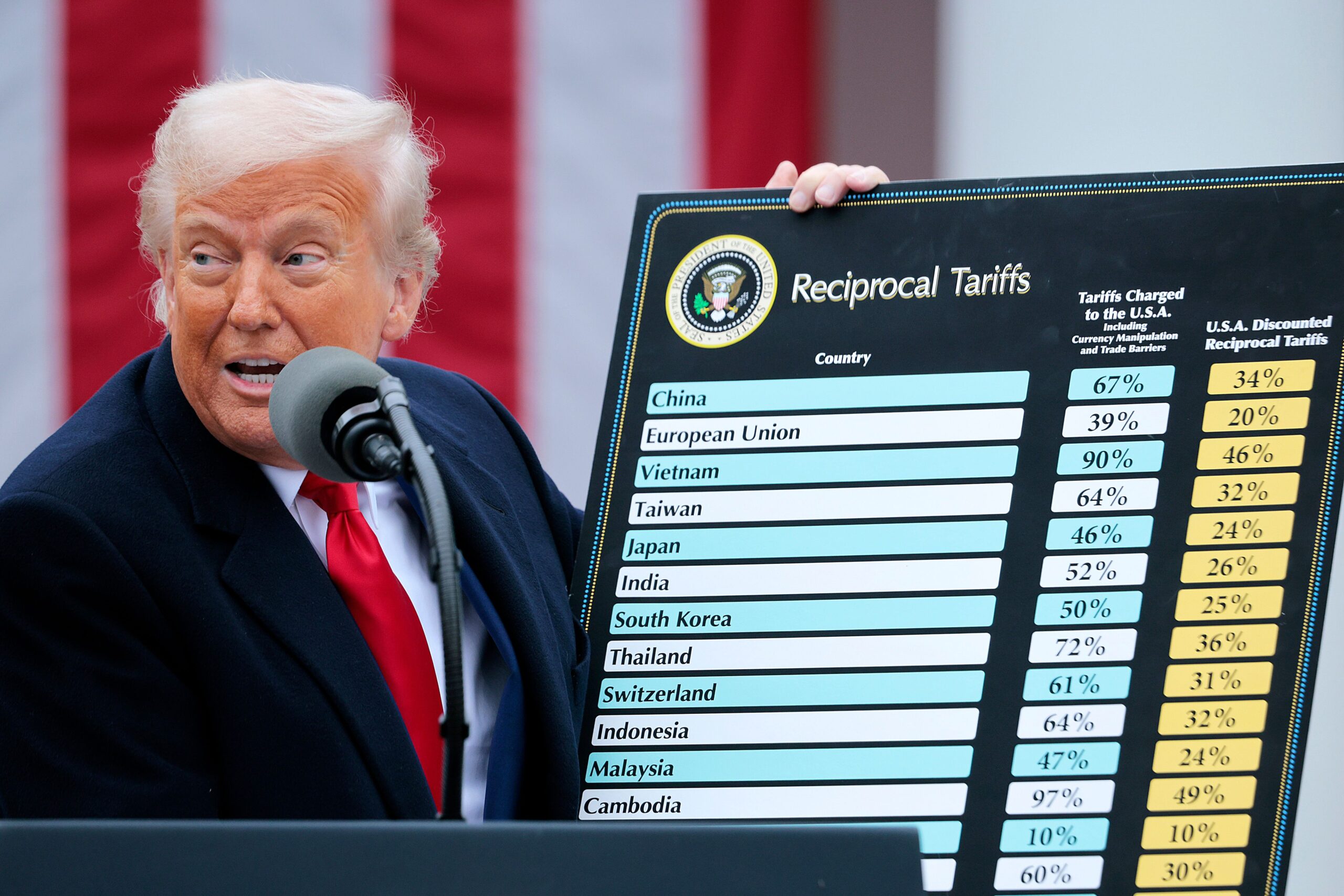

rose and inventory index futures surged early Thursday after a U.S. courtroom declared President Donald Trump’s broad-based tariffs regime invalid. The constructive sentiment was buoyed by AI large Nvidia’s upbeat earnings.

On-chain knowledge confirmed massive wallets, these holding over 10,000 BTC, have shifted to promoting from shopping for as the most important cryptocurrency holds near its report excessive, with a rise in change deposits additionally pointing to promoting strain. In the meantime, choices market knowledge signaled potential for volatility forward of Friday’s month-to-month settlement.

Ether

, the second-largest cryptocurrency by market worth, jumped to $2,780, the best since Feb. 24, in step with the bullish alerts from the derivatives market. The token has been bid this week, supposedly on SharpLink’s $425 million Treasury plan. Notably, U.S.-listed spot ether ETFs noticed a web influx of $84.89 million on Wednesday, extending their streak to eight consecutive days.

Canada-listed funding agency Sol Methods mentioned it filed a preliminary prospectus with native securities regulators to boost as much as $1 billion to spice up its funding within the Solana ecosystem. Nonetheless, SOL was flattish at round $170.

Within the broader market, TON, PEPE and FLOKI led different cash increased whereas FARTCOIN, PI and JUP nursed most losses. Open curiosity in TON perpetual futures surged 33% to $190 million, clocking the best since Feb. 18.

Stablecoin issuer Circle froze wallets related to the Libra token containing thousands and thousands of {dollars} value of USDC. Metaplanet issued $21M in bonds to finance extra bitcoin purchases.

In conventional markets, some funding banks mentioned Trump has different instruments to sidestep the courtroom ruling on tariffs. Yields on the longer length Treasury notes ticked increased, suggesting greenback power. Keep alert!

What to Watch

- Crypto

- Macro

- Could 29, 8 a.m.: The Brazilian Institute of Geography and Statistics (IBGE) releases April unemployment charge knowledge.

- Unemployment Fee Est. 6.9% vs. Prev. 7%

- Could 29, 8:30 a.m.: The U.S. Bureau of Financial Evaluation (BEA) releases Q1 GDP knowledge.

- GDP Development Fee QoQ (2nd estimate) Est. -0.3% vs. Prev. 2.4%

- GDP Worth Index QoQ (2nd estimate) Est. 3.7% vs. Prev. 2.3%

- GDP Gross sales QoQ (2nd estimate) Est. -2.5% vs. Prev. 3.3%

- Could 29, 2 p.m.: Fed Governor Adriana D. Kugler will ship a speech on the fifth Annual Federal Reserve Board Macro-Finance Workshop (digital). Livestream hyperlink.

- Could 30, 8 a.m.: The Brazilian Institute of Geography and Statistics (IBGE) releases Q1 GDP knowledge.

- GDP Development Fee QoQ Est. 1.4% vs. Prev. 0.2%

- GDP Development Fee YoY Est. 3.2% vs. Prev. 3.6%

- Could 30, 8 a.m.: Mexico’s Nationwide Institute of Statistics and Geography releases April unemployment charge knowledge.

- Unemployment Fee Est. 2.5% vs. Prev. 2.2%

- Could 30, 8:30 a.m.: Statistics Canada releases Q1 GDP knowledge.

- GDP Development Fee Annualized Est. 1.7% vs. Prev. 2.6%

- GDP Development Fee QoQ Prev. 0.6%

- Could 30, 8:30 a.m.: The U.S. Bureau of Financial Evaluation (BEA) releases April shopper earnings and expenditure knowledge.

- Core PCE Worth Index MoM Est. 0.1% vs. Prev. 0%

- Core PCE Worth Index YoY Est. 2.5% vs. Prev. 2.6%

- PCE Worth Index MoM Est. 0.1% vs. Prev. 0%

- PCE Worth Index YoY Est. 2.2% vs. Prev. 2.3%

- Private Earnings MoM Est. 0.3% vs. Prev. 0.5%

- Private Spending MoM Est. 0.2% vs. Prev. 0.7%

- Could 30, 10 a.m.: The College of Michigan releases (ultimate) Could U.S. shopper sentiment knowledge.

- Michigan Shopper Sentiment Est. 51 vs. Prev. 52.2

- Could 29, 8 a.m.: The Brazilian Institute of Geography and Statistics (IBGE) releases April unemployment charge knowledge.

- Earnings (Estimates primarily based on FactSet knowledge)

Token Occasions

- Governance votes & calls

- Unlocks

- Could 31: Optimism (OP) to unlock 1.89% of its circulating provide value $24.43 million.

- June 1: Sui (SUI) to unlock 1.32% of its circulating provide value $160.58 million.

- June 1: ZetaChain (ZETA) to unlock 5.34% of its circulating provide value $11.18 million.

- June 12: Ethena (ENA) to unlock 0.7% of its circulating provide value $15.83 million.

- June 12: Aptos (APT) to unlock 1.79% of its circulating provide value $60.96 million.

- Token Launches

- June 1: Staking rewards for staking ERC-20 OM on MANTRA Finance finish.

- June 16: Suggested deadline to unstake stMATIC as a part of Lido on Polygon’s sunsetting course of ends.

- June 26: Coinbase to delist Helium Cellular (MOBILE), Render (RNDR), Ribbon Finance (RBN), & Synapse (SYN)

Conferences

Token Speak

By Oliver Knight

- Markets on the Ethereum-based Cork Protocol stay paused after Wednesday’s $12 million smart-contract exploit.

- The attacker manipulated the sensible contact’s exchange-rate perform by issuing pretend tokens, stealing 3,761.8 wrapped staked ether (wstETH) within the course of.

- The exploit marked one other assault on the decentralized finance (DeFi) business simply days after Sui-based Cetus Protocol misplaced $223 million to an exploit.

- TRM Labs estimates that $2.2 billion was stolen in crypto exploits and hacks in 2024.

- Ether stays unperturbed by the exploit, main the market in the present day on the again of renewed institutional curiosity and spot ETF flows. It’s up 3.8% prior to now 24 hours whereas bitcoin is down by 0.17%.

Derivatives Positioning

- TRX, XMR, ETH, LTC and BNB led main cryptocurrencies’ development in perpetual futures open curiosity.

- Funding charges for majors, besides TON, sign bullish sentiment, however nothing extraordinary.

- On the CME, ETH annualized one-month futures foundation topped 10%, whereas BTC lagged at 8.7%.

- Indicators of warning emerged on Deribit, with front-end BTC skew flipping to places and ETH’s name skew softening. Block flows on Paradigm featured demand for short-dated BTC places.

Market Actions

- BTC is up 1.15% from 4 p.m. ET Wednesday at $108,594.41 (24hrs: -0.29%)

- ETH is up 3.9% at $2,738.04 (24hrs: +3.63%)

- CoinDesk 20 is up 2.21% at 3,278.84 (24hrs: +0.66%)

- Ether CESR Composite Staking Fee is unchanged at 3.1%

- BTC funding charge is at 0.0057% (6.3006% annualized) on Binance

- DXY is up 0.12% at 99.99

- Gold is up 0.32% at $3,304.20/oz

- Silver is up 1.24% at $33.41/oz

- Nikkei 225 closed +1.88% at 38,432.98

- Cling Seng closed +1.35% at 23,573.38

- FTSE is unchanged at 8,724.05

- Euro Stoxx 50 is unchanged at 5,378.39

- DJIA closed on Wednesday -0.58% at 42,098.70

- S&P 500 closed -0.56% at 5,888.55

- Nasdaq closed -0.51% at 19,100.94

- S&P/TSX Composite Index closed unchanged at 26,283.50

- S&P 40 Latin America closed -0.76 at 2,599.53

- U.S. 10-year Treasury charge is up 6 bps at 4.54%

- E-mini S&P 500 futures are up 1.53% at 5,993.25

- E-mini Nasdaq-100 futures are up 2.03% at 21,814.25

- E-mini Dow Jones Industrial Common Index futures are up 0.96% at 42,576.00

Bitcoin Stats

- BTC Dominance: 63.71 (-0.06%)

- Ethereum to bitcoin ratio: 0.02517 (1.12%)

- Hashrate (seven-day transferring common): 910 EH/s

- Hashprice (spot): $57.0

- Whole Charges: 8.03 BTC / $868,310

- CME Futures Open Curiosity: 152,995 BTC

- BTC priced in gold: 32.8 oz

- BTC vs gold market cap: 9.30%

Technical Evaluation

- The VIRTUAL token has topped the 38.2% Fibonacci retracement of the January-April crash.

- The escape above the extensively tracked resistance may entice extra consumers, yielding a much bigger rally.

Crypto Equities

- Technique (MSTR): closed on Wednesday at $364.25 (-2.14%), +2.43% at $373.09 in pre-market

- Coinbase International (COIN): closed at $254.29 (-4.55%), +3.01% at $261.95

- Galaxy Digital Holdings (GLXY): closed at C$28 (-6.57%)

- MARA Holdings (MARA): closed at $14.86 (-9.61%), +4.04% at $15.46

- Riot Platforms (RIOT): closed at $8.38 (-8.32%), +2.86% at $8.62

- Core Scientific (CORZ): closed at $10.78 (-4.43%), +2.97% at $11.10

- CleanSpark (CLSK): closed at $9.11 (-7.61%), +3.62% at $9.44

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $17.27 (-5.32%)

- Semler Scientific (SMLR): closed at $41.32 (-4.77%), +2.95% at $42.54

- Exodus Motion (EXOD): closed at $25.94 (-25.35%), +11.6% at $28.95

ETF Flows

Spot BTC ETFs

- Day by day web stream: $432.7 million

- Cumulative web flows: $45.31 billion

- Whole BTC holdings ~ 1.21 million

Spot ETH ETFs

- Day by day web stream: $84.9 million

- Cumulative web flows: $2.9 billion

- Whole ETH holdings ~ 3.57 million

Supply: Farside Traders

In a single day Flows

Chart of the Day

- The MOVE index, which measures the volatility in U.S. Treasury notes, has dropped to the bottom degree since March.

- If it drops additional, a continued decline is more likely to ease monetary circumstances, greasing the bitcoin bull run.