Bitcoin

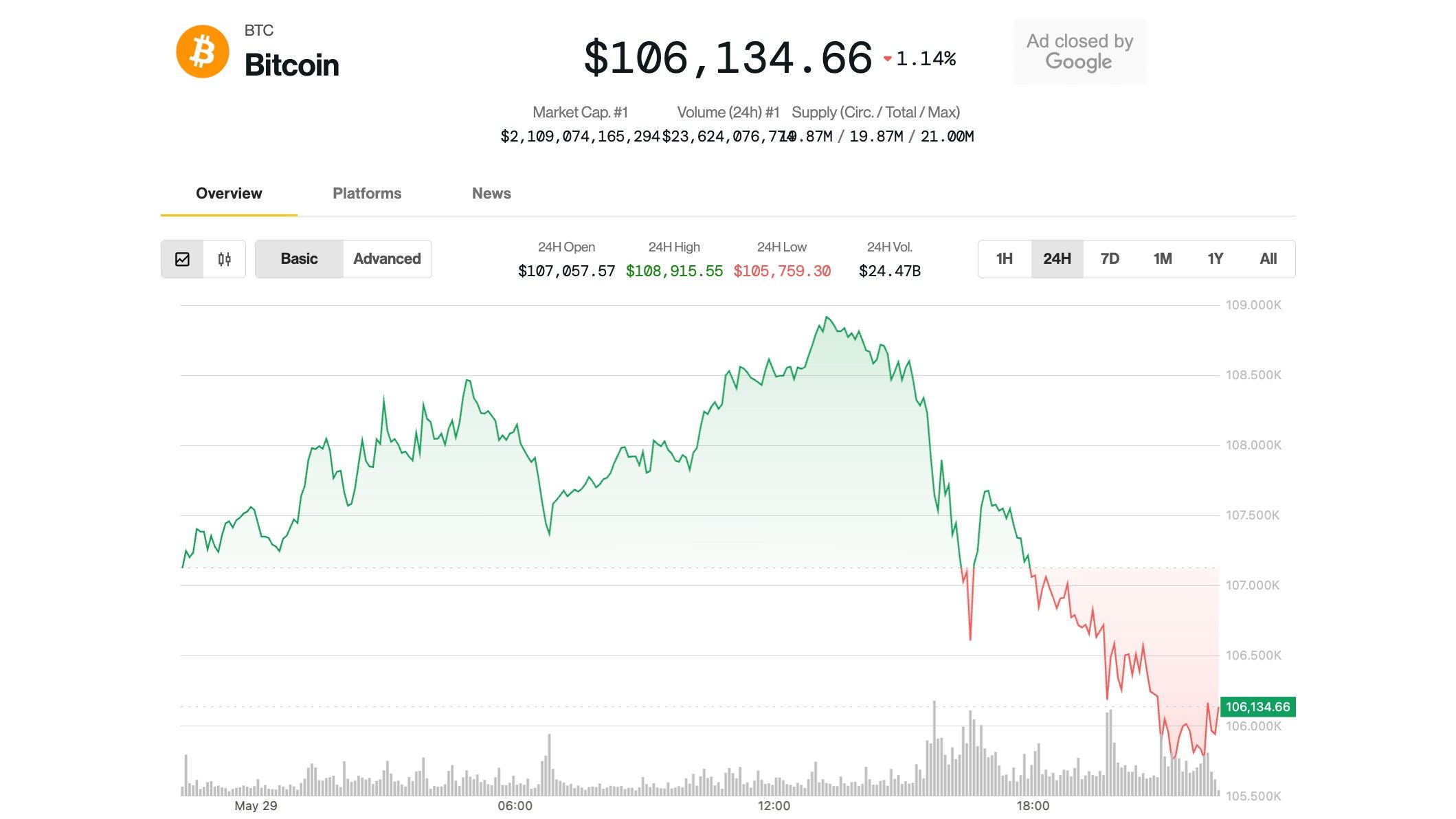

quietly slid to its weakest value in 9 days on Thursday afternoon as crypto markets cooled off after a multi-week rally from the April lows.

The highest cryptocurrency hit a session low of $105,750 earlier than rebounding to only above $106,000. It was down 1.5% within the final 24 hours, however nonetheless solely 5% away from file excessive ranges.

The CoinDesk 20 — an index of the highest 20 cryptocurrencies by market capitalization apart from trade cash, memecoins and stablecoins — has slumped 0.9% within the final 24 hours, with solana

and avalanche underperforming BTC with losses of 1.8% and a couple of%, respectively. In the meantime, Ethereum’s ether and XRP defied the downtrend with 1%-2% features.

Crypto shares have had a comparatively muted session. Coinbase (COIN) is down 2.7% however Technique (MSTR) has risen 0.8%. Bitcoin mining corporations Bitfarms (BITF), Bit Digital (BTBT), CleanSpark (CLSK) and Greenidge Era Holding (GREE) booked roughly 4% losses.

A verify on conventional markets confirmed U.S. equities giving again many of the features on yesterday’s court docket ruling that blocked the Trump administration’s world tariffs.

Nevertheless, a U.S. appeals court docket as we speak reinstated the tariffs whereas the federal government appealed the sooner ruling, maybe including to investor uncertainty.

LMAX Group market strategist Joel Kruger expects a risky trip with tariffs once more again in focus with the continued enchantment and the self-imposed July 9 deadline for commerce offers approaching, however nonetheless sees additional upside for digital property.

“Bitcoin stays strong within the latter half of the week, consolidating slightly below its latest peak whereas steadfastly holding above $100,000 for 20 consecutive days, underscoring persistent bullish momentum,” he mentioned.

Ether exhibits energy, analysts notice

Kruger additionally famous that Ethereum’s ether exhibits indicators of snapping its multi-year downtrend towards BTC, as the company crypto treasury bonanza has reached the second-largest digital asset with SharpLink Gaming’s (SBET) $425 million fundraising plan.

Arthur Aziz, founder and investor of B2 Ventures, mentioned that ETH is coiling for a breakout however warned of draw back dangers.

Sharing his technical evaluation in a notice, he mentioned the $2,750 stage has posed important barrier capping features over the previous weeks, whereas the $2,550-2,450 space emerged as a key help stage. He famous that ETH is forming a bullish ascending triangle sample, which traditionally preceded rallies to larger costs.

“The stage for a future $3,000 stage breakout is being set proper now,” he mentioned. Nevertheless, “abusing” leverage in futures markets may set off a “sharp breakdown” beneath the $2,550-2,450 help zone in cascading promoting.