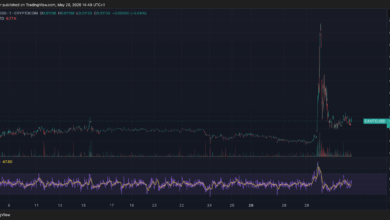

Bitcoin crossed the six-figure line for the primary time this 12 months in March and spent April drifting close to the excessive $90,000 space. Might opened at $96,505 and on Might 22 printed a brand new report at $111,700, a 15.7 % advance in three weeks.

Since then, the value has been hovering above $107,000, whereas turnover on derivatives far outpaced spot, displaying the place risk-taking was concentrated.

Throughout April, the market recorded a mean of 32,403 BTC in day by day spot quantity and 439,043 BTC on futures venues, putting the spot-to-derivative ratio at 0.0739. Throughout Might, these numbers slid to 23,766 BTC and 350,734 BTC, respectively. That pushed the ratio right down to 0.0702 and lifted the by-product share of whole exercise to 93.7 %, the best month-to-month print this 12 months.

Summed throughout the 26 noticed buying and selling days, Might delivered 618,000 BTC of spot turnover versus 9.12 million BTC on futures books. In greenback phrases, utilizing the day by day shut equates to roughly $67 billion in money trades and greater than $990 billion in futures publicity. That is the bottom the ratio has been since 2023 and exhibits how far the market has migrated towards contract-based exercise since ETFs arrived in early 2024.

This month’s first buying and selling day noticed 9,435 BTC commerce on spot books in opposition to 377,196 BTC on futures, a ratio of 0.0746. On Might 22, spot ticks reached 31,599 BTC whereas derivatives surged to 467,328 BTC; the ratio compressed to 0.0677. By Might 26, with value cooling to $109,460, spot quantity fell to 14,967 BTC, however futures nonetheless printed 289,617 BTC, leaving the ratio at 0.0597, the bottom degree of the month.

Open curiosity adopted quantity. Futures worth locked in contracts climbed from $65.81 billion on Might 18 to $80.91 billion on Might 22. The soar lined up with the report value and pushed the OI-to-market-cap ratio past 0.05 for the primary time, flagging a gearing issue better than 1:20 on many venues.

The sample is obvious: every leg greater in value got here with a proportionally bigger improve in futures turnover, whereas spot demand light as soon as the height was printed. This profile factors to cost discovery pushed by funding-backed positioning quite than outright shopping for on money exchanges. With greater than 9 out of each ten traded cash now biking by means of contracts, small funding changes can amplify value swings shortly.

Funding charges already mirror the heavier gearing. Information from Might 21 to Might 23 present the open-interest-weighted charge climbing from 0.0061 % to 0.0181 % earlier than sliding again to 0.0064 %. That bump lined up with the report excessive, displaying how little spot move was required as soon as perpetual prices turned optimistic. If charges flip detrimental, the identical mechanism can decrease the value by means of mass place trimming.

Spot exchange-traded funds add one other variable. Web inflows between Might 15 and Might 22 totaled $2.1 billion, but the value rally outpaced that money by a large margin when measured in opposition to derivatives quantity. With spot desks quiet, any giant ETF redemption may drive liquidity seekers into futures markets and intensify strikes.

Institutional merchants clearly favor derivatives over spot. Throughout the week of the report, the US 10-year yield eased eight foundation factors and the greenback index slipped 0.6 %. Foundation trades that quick the entrance month and purchase spot to earn funding narrowed barely, in step with the yield transfer, however by no means widened sufficient to entice a wholesale pivot again to money markets.

Till observable money shopping for strengthens, the market sits on a tower of geared positions that may amplify positive factors and drawdowns. A sustained rebound in spot share would create a firmer basis for Bitcoin’s value, whereas one other sharp correction may depart Bitcoin’s value uncovered to pressured unwinds from the derivatives market.

The put up Futures desks made 9 out of 10 Bitcoin trades in Might whereas spot exercise slowed down appeared first on CryptoSlate.