What occurs when retail logs off from crypto and Wall Avenue tunes in? Taking a look at bitcoin’s

current all-time-high, one would say it feels bullish and the trade is maturing.

That may as effectively be the case, however we’d not be there but. So earlier than we flooring our Lambos, let’s look below the hood.

First issues first, retail buyers have mainly ghosted this rally. A fast search on Google Traits utilizing the key phrase “bitcoin” exhibits that the surge that was seen again in 2021’s bull market is non-existent. Again then, everybody and their grandmothers had been Googling bitcoin, aping into altcoins and flooding the social media with rocket emojis. In 2025? It is a ghost city in retail-land.

There was a blip of excessive retail curiosity surrounding the U.S. presidential election, when a short-lived memecoin mania took over retail sentiment. Nevertheless, that surge is lengthy gone, as memecoin costs tanked swiftly, whilst bitcoin hit an all-time excessive this week, ripping previous $111,000.

“Early on this cycle, memecoins turned a focus of dangerous retail-driven buying and selling with associated buying and selling peaking in January,” stated Toronto-based crypto platform FRNT Monetary. “Nevertheless, since then, there was a digital wash-out of curiosity and memecoin buying and selling exercise,” which exhibits “the tepid danger urge for food in crypto for the time being,” FRNT added.

Translation: “Wen Lambo” crowd obtained burned, they usually aren’t speeding again into the race monitor en masse anytime quickly.

From Lambos to Corollas

On the subject of danger urge for food, let’s return to the automotive analogy.

Throughout the 2021 bull market, folks purchased unreliable efficiency automobiles, stripped out the brakes and seatbelts to go sooner than ever earlier than, and didn’t care that there may be engine blowouts. So long as there was a promise of reaching the moon, bullish vibes had been all that mattered.

Now? After shedding super quantities of cash on these unsustainable go-fast automobiles for years, merchants are driving Toyota Corollas—wise sedans which might be sluggish however regular and nonetheless on the street.

That risk-off sentiment can also be evident from the funding charges, in accordance with FRNT’s evaluation of BTC perp charges—a measure of how a lot merchants are keen to pay to take care of their lengthy positions. When bitcoin reached a report excessive of round $42,000 in January 2021, the perp price was about blistering 185%. In the present day, at bitcoin close to $110,000, the speed is close to 20% on crypto choices change Deribit, which means the danger urge for food is not utterly gone however nowhere close to the 2021 frenzy.

ATH jitters

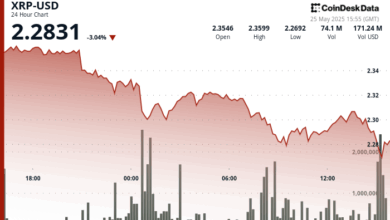

A 3rd level so as to add is the excessive variety of quick positions out there.

As CoinDesk’s Oliver Knight reported this week, the bitcoin lengthy/quick ratio is at its lowest level because the crypto winter in September 2022. This means that almost all of the merchants aren’t utterly shopping for into this current constructive momentum and betting on bitcoin transferring decrease as a hedge for the brand new bullish rally.

The affect of such positioning was clear on Friday, when bitcoin swiftly crashed from close to $111,000 to $108,000 in a matter of minutes after which bounced proper again as much as $109,000. The anxiousness of a swift volatility is actual.

So in a car-themed analogy, the drivers (on this case, buyers) are nonetheless taking out their super-modified, unreliable sports activities automobiles for a weekend drive on the monitor. Nonetheless, additionally they have their Corollas following alongside. Simply in case the engine blows on their go-fast automobiles.

Cautious optimism

Given the present macro-risk, it is not solely shocking that buyers are on their toes and risk-averse. However this may simply be precisely what your mechanic on the store prescribed. In truth, this may be an indicator of a sustainable rally in the long run.

“Intervals of low leverage and danger urge for food in crypto have typically preceded additional sustainable features,” in accordance with FRNT.

“BTC seems to be in such a section, set towards a backdrop of quite a few bullish catalysts and narratives,” the agency added.

The underside line is that the retail Lambos might need been towed away, however huge cash is stepping in with their eternal Toyotas. This may begin a sluggish however regular race to the moon, not only a reckless joyride.

Learn extra: These Six Charts Clarify Why Bitcoin’s Current Transfer to Over $100K Could Be Extra Sturdy Than January’s Run