Bitcoin’s

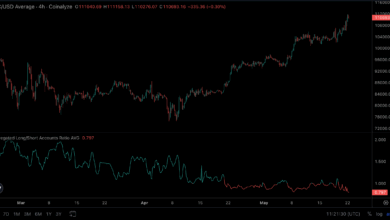

greenback excessive succumbed on Thursday as the biggest cryptocurrency rose previous $111,800, a outstanding 50% acquire from its April low close to $75,000, however when measured in opposition to conventional shops of worth like gold and silver, BTC — usually dubbed “digital gold” — nonetheless has room to advance.

The bitcoin-to-gold ratio stands at 33.27 ounces, under its January peak of over 40 oz. BTC has additionally not reached an all-time excessive in opposition to silver, although it has simply breached the three,300 oz. degree, in contrast with the report 3,530 oz.

The digital gold moniker displays bitcoin’s fastened provide and decentralized nature, and it is more and more dwelling as much as the identify. In current weeks, it has outperformed U.S. equities, which stay sluggish for the yr regardless of recovering from their April tariff-tantrum induced downturn.

In fiat phrases, bitcoin is nearing important psychological milestones throughout different currencies too. It at present trades round 82,500 British kilos, simply shy of its all-time excessive of 88,300 kilos, and at 91,500 Swiss francs, versus a earlier peak just below 100,000 francs. These ranges trace at imminent breakthroughs as bitcoin positive aspects additional power.

Notably, BTC has already achieved all-time highs relative to main monetary devices just like the Nasdaq 100 and the iShares 20+ 12 months Treasury Bond ETF (TLT). Its continued outperformance of each bonds and tech shares underscores a broader development. The ultimate frontier stays valuable metals. Surpassing gold and silver benchmarks will mark an entire reversal of financial dominance.