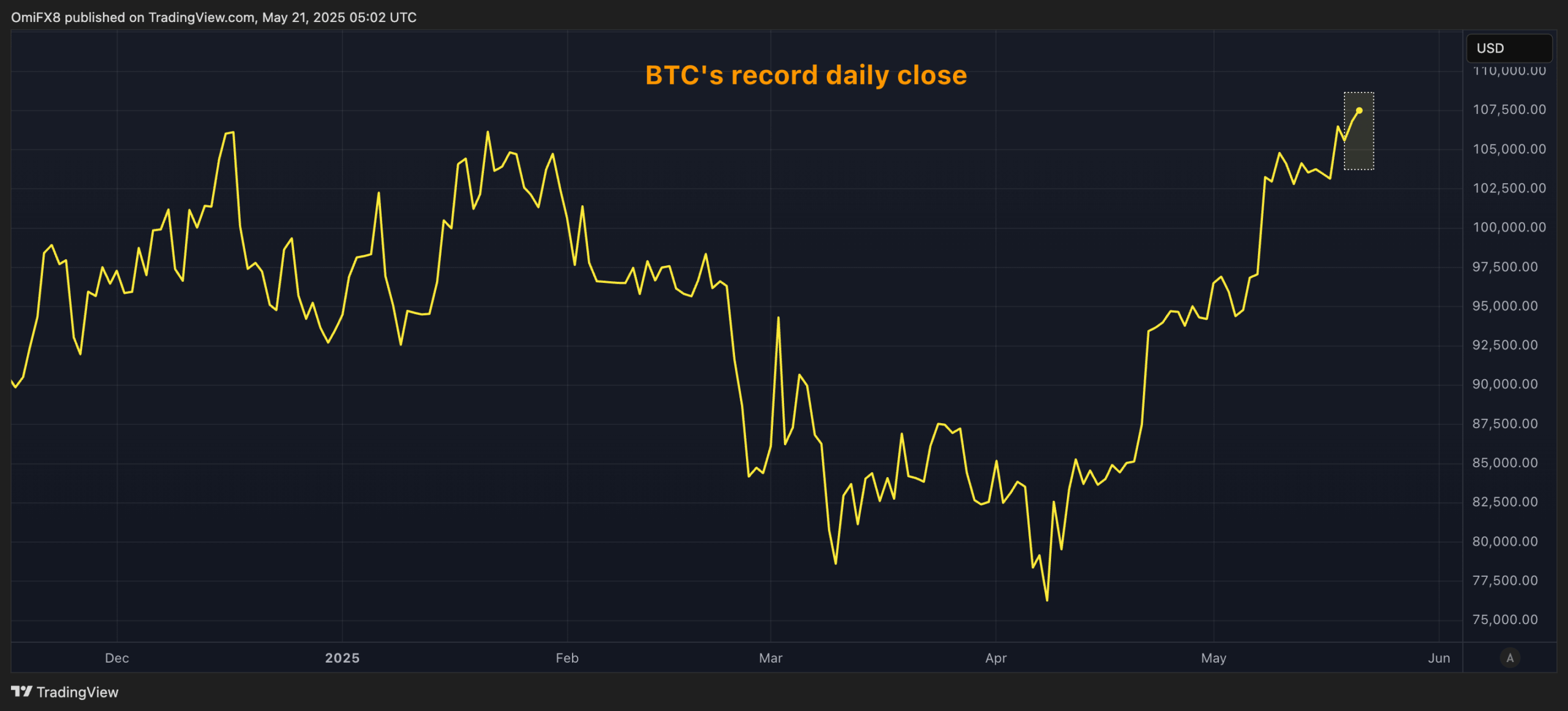

Though bitcoin (BTC) could be traded 24/7 its candles open and shut day by day much like overseas alternate markets. The newest information from TradingView exhibits Tuesday’s candle ended (UTC) at $106,830, the highest-ever day by day closing worth.

The bullish transfer got here as buyers poured cash into the spot exchange-traded funds (ETFs) amid chaotic worth motion in bond markets that steered heightened issues concerning the fiscal well being of main economies, together with the U.S.

Analysts instructed CoinDesk final week that the worsening fiscal debt state of affairs may bode nicely for BTC and different belongings resembling gold.

The Coinbase Bitcoin Premium Index, which measures the share distinction between the value of Bitcoin on Coinbase Professional (USD pair) and the value on Binance (USDT buying and selling pair), remained optimistic, indicating a persistent shopping for strain from the U.S.-based buyers.

With the uptrend in progress, the subsequent key stage to observe is $110,000. Knowledge from Deribit’s BTC choices market, tracked by Amberdata, exhibits sellers or market makers maintain a big internet “unfavorable gamma” publicity on the $110,000 stage.

Sellers holding unfavorable gamma usually commerce/hedge within the course of the market to keep up their total market publicity delta impartial. That, in flip, amplifies bearish and bullish strikes.

In different phrases, the rally could speed up on a possible breakout above the $110,000 mark. The choices market has grown considerably over the previous 5 years, with supplier hedging including to volatility on a number of events.