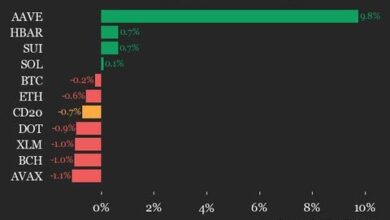

Key factors:

-

Bitcoin isn’t in line to cancel its assault on all-time highs, says the Bitcoin Elementary Index (BFI).

-

BTC value energy stays “intact,” says Swissblock Applied sciences, eradicating the danger of a double high.

-

Traditionally, a return to inside 10% of all-time highs delivers value discovery nearly each time.

Bitcoin (BTC) doesn’t threat a “double high” bull market reversal with its journey previous $107,000, new evaluation says.

In one among its newest X updates, personal wealth supervisor Swissblock Applied sciences described BTC value energy as “intact.”

BTC value indicator ignores double high “noise”

Bitcoin exhibits “no indicators of bearish divergence,” as seen by the lens of a basket of community indicators.

Commenting on the newest alerts from its Bitcoin Elementary Index (BFI), Swissblock argues that regardless of being lower than $5,000 from all-time highs, BTC/USD isn’t about to desert its push into value discovery.

“A variety of noise a few potential double high as $BTC struggles to interrupt ATH,” it summarized.

BFI combines numerous extant indicators right into a single oscillator to supply perception into development energy at a given value level.

Since August 2024, BFI has caught rigidly to its center territory across the 50/100 mark, no matter value motion.

“Even throughout the Feb–Mar pullback, it held impartial, by no means dipped into weak spot,” the put up notes.

Swissblock defined that if BTC/USD have been to reverse now and head decrease, leaving all-time highs untouched, BFI would already be “breaking down.”

“On-chain energy is unbroken,” it concludes.

“Bears: not this time, received to attend.”

Stats favor Bitcoin bulls

That perspective chimes with that of the vast majority of widespread crypto market contributors this month.

Associated: $107K fakeout or new all-time highs? 5 issues to know in Bitcoin this week

As Cointelegraph continues to report, value discovery is anticipated to reenter sooner fairly than later, with one BTC value goal for this week already at $116,000.

On that matter, community economist Timothy Peterson used statistical evaluation to imagine a visit to a minimum of $115,000 by the top of June.

“Bitcoin has pulled to inside 10% of its all-time excessive,” a part of his personal X put up from Might 9 reads.

“What occurs subsequent? This has occurred almost 300 instances since 2015. Inside 50 days, Bitcoin made a brand new all-time excessive 98% of the time.”

Peterson acknowledged that post-2020 positive aspects have been extra modest than these earlier than, with a mean 8% transfer giving BTC/USD a goal of as much as $125,000.

This text doesn’t include funding recommendation or suggestions. Each funding and buying and selling transfer includes threat, and readers ought to conduct their very own analysis when making a call.