Report highs — be it $20,000 in 2017, $69,000 in 2021 and $109,000 this yr — are nice for headlines and fast comparisons, however in actuality do not do a fantastic job of describing worth motion.

Monitoring the “realized worth,” or the common worth at which bitcoin

is withdrawn from all exchanges to estimate a market-wide value foundation is a extra beneficial device for gauging investor profitability and potential inflection factors in market sentiment.

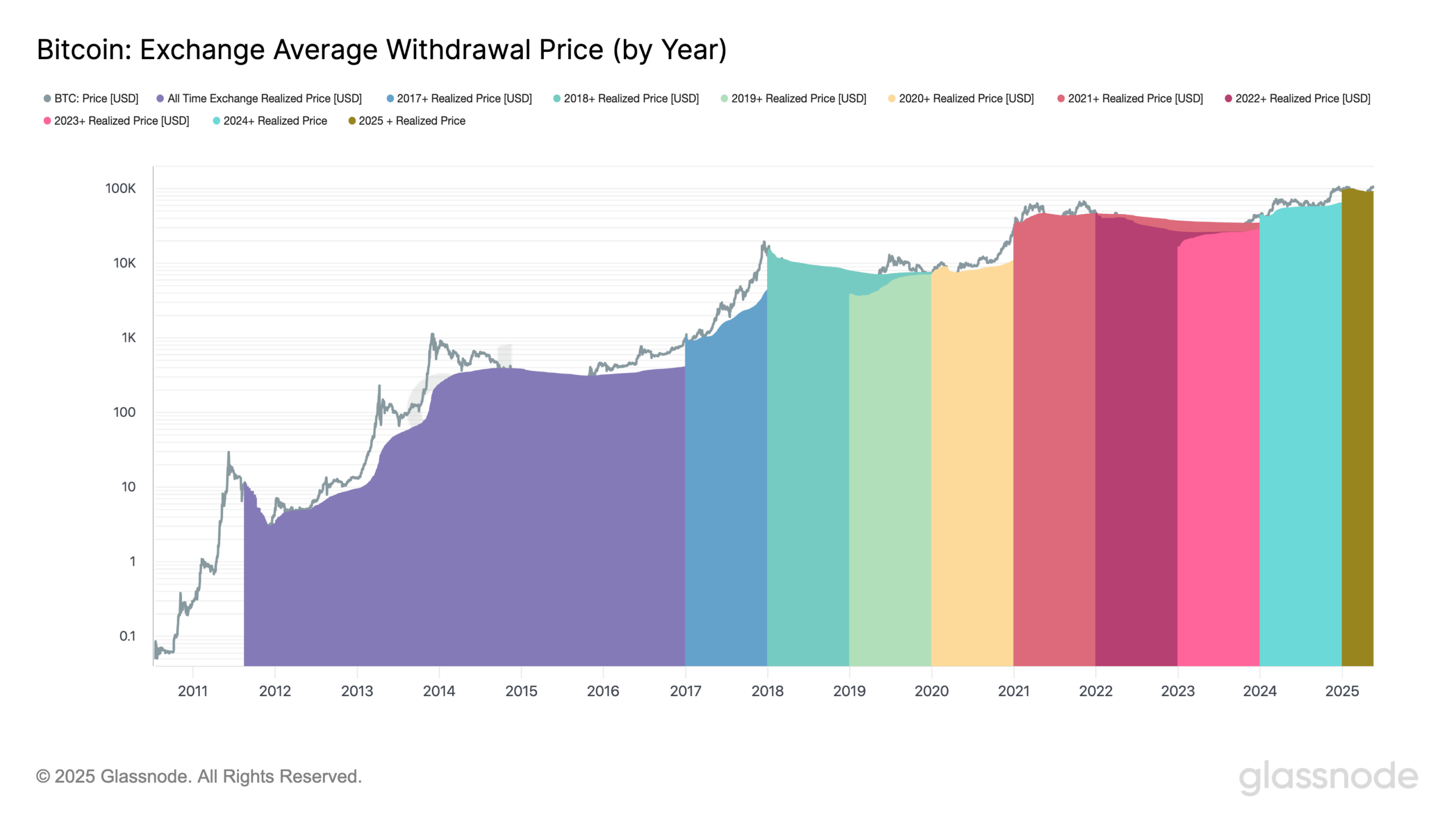

The charts (above and beneath) illustrate the common withdrawal costs for various investor cohorts, segmented by the yr they entered the market beginning Jan. 1 of every yr from 2017 to 2025.

The common realized worth for the 2025 to date is $93,266. With bitcoin presently buying and selling at $105,000, these traders are up roughly 12% on common.

When bitcoin started its decline from the all-time excessive of $109,000 in late January, it briefly fell beneath the 2025 realized worth, a historic sign of capitulation. This era of stress lasted till April 22, when the value reclaimed the cohort’s value foundation.

Historic Context: Capitulation Patterns

Traditionally, when worth falls beneath a cohort’s realized worth, it typically marks market capitulation and cyclical bottoms:

- 2024: After the ETF launch in January, bitcoin dipped beneath the common value foundation earlier than rebounding. A extra vital capitulation adopted in the summertime, linked to the yen carry commerce unwind when bitcoin plunged to $49,000.

- 2023: Worth tracked near the common value foundation throughout help ranges, solely briefly breaking beneath through the Silicon Valley Financial institution disaster in March.

The info suggests {that a} capitulation part has possible occurred, positioning the marketplace for a extra constructive part. Traditionally, recoveries from such occasions mark transitions into more healthy market circumstances.

Realized, not report

When bitcoin first surpassed $20,000 through the 2017 bull market, it marked a major divergence between the market worth and the realized worth of simply $5,149, highlighting a part of exuberant hypothesis. Unsurprisingly, costs very shortly after went right into a brutal reversal.

In distinction, by the depths of the 2018 bear market when bitcoin bottomed round $3,200, worth at that time converged with the all-time realized worth, a metric that aggregates the fee foundation of all traders throughout cycles.

This long-term value foundation acts as a foundational help degree in bear markets and progressively rises over time as new capital enters the market. Subsequently, evaluating bitcoin solely by evaluating cycle peaks, for instance, from $69,000 in 2021 to simply over $100,000 in 2025, misses the larger image.

The extra related perception is that the combination value foundation of all traders continues to climb, underscoring the long-term maturation of the asset and the growing depth of capital dedicated to the community.