Two of the most important company Bitcoin holders, Technique (previously MicroStrategy) and Japan-based Metaplanet, have considerably expanded their crypto treasuries this week.

In response to separate Might 19 bulletins, each companies collectively acquired 8,394 BTC, spending almost $870 million. This follows their shopping for spree the earlier week, when the businesses added virtually 15,000 BTC.

Consequently, the 2 firms have accrued over 23,000 BTC price greater than $2 billion previously two weeks, signaling their agency conviction in Bitcoin’s long-term worth.

Technique tops 576K BTC however faces investor backlash

On Might 19, Technique reported to the US Securities and Alternate Fee (SEC) that it acquired 7,390 BTC between Might 12 and Might 18.

The agency stated it spent $764.9 million on this buy, which suggests every coin was bought at a median value of $103,498.

The corporate funded the newest acquisition by promoting shares. It raised $705.7 million from promoting over 1.7 million MSTR shares and one other $59.7 million from 621,555 STRK shares.

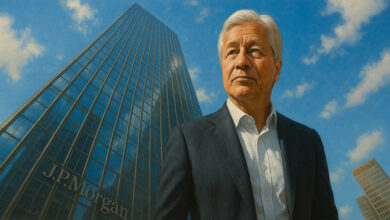

In the meantime, the newest purchase pushes the Michael Saylor-led agency’s complete holdings to 576,230 BTC, making it the most important Bitcoin holder amongst publicly traded firms.

In response to the SEC submitting, these belongings had been acquired at roughly $40.18 billion, implying a median value of $69,726 per Bitcoin. At present market charges, the agency’s stash is valued at round $59.09 billion, with almost $19 billion in unrealized beneficial properties.

Nevertheless, regardless of the beneficial properties, Technique’s Bitcoin-first strategy seems to have sparked authorized challenges from disgruntled shareholders.

On Might 18, Pomerantz LLP filed a category motion lawsuit with no lead plaintiff, claiming the Technique misled shareholders on the identical day it filed over 50 different class-action fits in opposition to different firms.

The complaints argued that the agency overstated Bitcoin’s potential returns and downplayed the dangers of the highest digital asset’s volatility. It additionally advised that the corporate’s public communications did not replicate materials dangers and should have misrepresented BTC’s long-term outlook.

The regulation agency behind this swimsuit is famend for submitting massive volumes of comparable circumstances, casting doubt on the variety of traders the swimsuit represents.

Metaplanet inventory outpaces Toyota after doubling down on Bitcoin

Metaplanet additionally confirmed it bought 1,004 BTC for roughly $104.6 million.

This marks the agency’s second buy above 1,000 BTC, bringing its complete holdings to 7,800 BTC price about $807 million.

The Tokyo-listed agency started accumulating Bitcoin in April 2024 and goals to achieve 10,000 BTC by the top of 2025. In response to information from the Bitcoin Treasuries, it now stands as Asia’s largest public holder of Bitcoin and ranks among the many international prime ten.

In the meantime, Metaplanet’s crypto technique seems to be paying off within the equities market.

On Might 19, Metaplanet CEO Simon Gerovich reported that the agency’s inventory was the ninth most traded on Japan’s exchanges, with a every day turnover of 61.69 billion yen (about $425 million), surpassing company giants like Toyota, SoftBank, and Nintendo.