Key takeaways:

-

Merchants anticipate a Bitcoin worth pullback to $90,000, however a bull flag may escape to new highs if revenue taking close to the vary highs reduces.

-

On-chain information suggests the present revenue taking is just too weak to extinguish Bitcoin’s present worth momentum.

Bitcoin (BTC) worth has spent the majority of the week pinned under $104,000 to $105,000, which many analysts have labelled as a resistance zone, however an alternate view means that BTC is solely consolidating inside a bull flag.

A bull flag is a continuation sample that’s characterised by a interval of sideways worth motion following a pointy uptrend, and when the construction confirms or breaks from the trendline resistance, the uptrend continues.

Whereas the range-bound buying and selling portion of the flag is claimed to signify indecision from consumers and sellers, on this situation, the absence of purchase quantity is the first perpetrator. As proven within the TRDR.io chart under, Bitcoin’s explosive transfer to $105,900 from $74,400 was accompanied by giant liquidations within the margin markets and strong spot volumes, which aligned with a number of days of billion-dollar spot BTC ETF inflows.

Throughout this three-week interval, a number of US-based and worldwide firms additionally introduced plans to buy Bitcoin and set up BTC treasuries. The spot and futures cumulative quantity delta, together with the open curiosity metric on the chart present merchants promoting close to the vary highs and the absence of latest lengthy leverage and considerably sized spot positions being opened on this space, whereas drops to vary low (bull flag assist) sees bids crammed on the spot aspect, however there’s nonetheless restricted use of margin for contemporary longs.

Bitcoin’s latest cool-down section is a standard final result after the close to 40% restoration that began on April 8, and the lack of upward momentum ensuing from profit-taking in futures markets close to the present vary excessive can also be to be anticipated.

Bitcoin short-term holder provide revenue and loss information from Glassnode helps this view, as proven within the chart under. The onchain information firm highlighted revenue taking for short-term merchants however defined that it doesn’t exceed the statistical norm, leaving room for additional worth upside.

“Lately, the magnitude of STH Realized Revenue has surged to virtually +3 normal deviations above its 90-day common, reflecting a notable uptick in revenue realization. In previous cycles, significantly throughout rallies in direction of the ATH, this metric has traditionally climbed to over +5 normal deviations of extra. This indicators that a lot stronger profit-taking stress is commonly required to overwhelm the influx demand.”

Associated: Bitfinex Bitcoin longs complete $6.8B whereas shorts stand at $25M — Time for BTC to rally?

Bitcoin ought to check underlying assist earlier than transferring increased

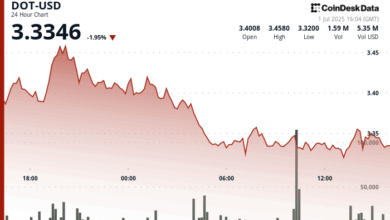

With the majority of Bitcoin’s obvious sell-side liquidity absorbed throughout the transfer to $105,000, some analysts warn {that a} transient flush down to check $100,000 to $90,000 as assist might be the following transfer for BTC worth.

Bitcoin market liquidity useful resource Materials Indicators stated, barring “a critical catalyst,“ […] BTC has a legit assist check at $100K, and FireCharts present that the order ebook is priming for that with asks stacking and bids transferring decrease.”

Sharing his view with X followers, analyst Daan Crypto Trades stated that the majority of bullish and bearish narratives with the potential to affect Bitcoin’s worth motion have “cleared up” and he famous that BTC worth has stalled close to its all-time excessive whereas shares have continued to rally after President Trump’s US-China commerce deal was confirmed.

The analyst stated that “$90K stays my long-term line within the sand for spot publicity,” including that he’s “cautiously bullish” with worth above $90,000 however that’s dependent upon how US fairness markets carry out within the quick time period.

“I’d not be stunned to see a short-term flush if shares have been to roll over and make the next low someplace. Contemplating most shares moved 30% to 50% in a single month, this wouldn’t be that loopy both.”

This text doesn’t include funding recommendation or suggestions. Each funding and buying and selling transfer entails threat, and readers ought to conduct their very own analysis when making a choice.