Key factors:

-

Bitcoin holds on to its current beneficial properties, growing the potential of a retest of the all-time excessive at $109,588.

-

BlackRock’s spot Bitcoin ETF information 19 days of successive inflows, displaying stable demand.

-

Choose altcoins are displaying energy, having damaged out of their massive basing patterns.

Bitcoin (BTC) made a decisive transfer above the psychologically essential $100,000 stage throughout the week, signaling that the bulls are again within the sport. Consumers are attempting to carry on to the ten% weekly beneficial properties over the weekend.

Bitcoin’s rally has been backed by stable inflows into the BlackRock spot Bitcoin exchange-traded fund (IBIT). Based on Farside Buyers’ knowledge, the fund stretched its inflows streak to 19 days, with the newest buying and selling week attracting $1.03 billion in inflows.

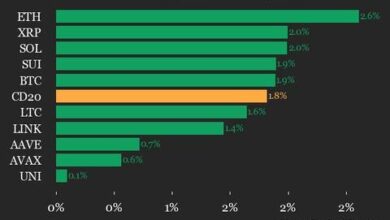

The rally was not restricted to Bitcoin alone, as a number of altcoins additionally moved increased. That has prompted analysts to announce the beginning of an altseason, with some predicting sharp rallies in altcoins over the subsequent few months. Nevertheless, not everybody believes that an altseason has began as a result of the altcoins have solely made modest strikes in comparison with the huge worth erosion from their respective all-time highs.

May Bitcoin escape to a brand new all-time excessive and preserve it? If it does, let’s examine the charts of the cryptocurrencies which will transfer increased within the close to time period.

Bitcoin worth prediction

Bitcoin has been steadily inching towards the all-time excessive of $109,588, indicating that the bulls are in no hurry to guide earnings.

The rally has pushed the relative energy index (RSI) into the overbought zone, suggesting a correction or consolidation within the close to time period. Any pullback is predicted to search out help between $100,000 and the 20-day exponential transferring common ($96,626). If the value rebounds off the help zone, it will increase the potential of a break above $109,588. If that occurs, the BTC/USDT pair might surge towards $130,000.

Time is operating out for the bears. In the event that they wish to make a comeback, they must swiftly yank the value under the 20-day EMA. In the event that they succeed, the pair might plunge to the 50-day easy transferring common ($88,962).

The pair continues to climb increased, however the bears are anticipated to fiercely defend the $107,000 to $109,588 zone. If the value turns down from the overhead zone, the 20-EMA is prone to act as sturdy help. A bounce off the 20-EMA alerts that the bullish momentum stays intact. That enhances the prospects of a breakout above $109,588.

Sellers must tug the value under $100,000 to weaken the optimistic momentum. That opens the doorways for a fall to $93,000 and subsequently to $83,000.

Ether worth prediction

Ether (ETH) skyrocketed from $1,808 on Might 8 to $2,600 on Might 10, indicating aggressive shopping for by the bulls.

The up transfer pushed the RSI into the overbought territory, indicating a minor pullback or consolidation is feasible within the close to time period. The primary help on the draw back is $2,320 after which $2,111. If the value turns up from the help ranges, the ETH/USDT pair might prolong the rally to $2,850 and later to $3,000.

The optimistic view shall be invalidated within the close to time period if the value breaks under $2,111. That would lead to a spread formation between $1,754 and $2,600.

The bulls pushed the value above the $2,550 resistance however couldn’t maintain the upper ranges. A minor optimistic in favor of the bulls is that they haven’t ceded a lot floor to the bears. That means the bulls are holding on to their positions as they anticipate the up transfer to proceed. If the value turns up from the present stage of the 20-EMA and breaks above $2,609, the rally might attain $3,000.

A deeper correction might start if the value continues decrease and plummets under the 20-EMA. That would sink the pair towards the stable help at $2,111.

Dogecoin worth prediction

Dogecoin (DOGE) soared above the $0.21 overhead resistance on Might 10, indicating a change within the short-term development.

The rally is dealing with promoting at $0.26, which might lead to a retest of the breakout stage of $0.21. If the value rebounds off $0.21 with energy, it suggests a change in sentiment from promoting on rallies to purchasing on dips. That will increase the chance of a rally to $0.31.

If consumers wish to forestall the upside, they must pull the value under the 20-day EMA ($0.19). In the event that they do this, the DOGE/USDT pair might swing inside a wide variety between $0.26 and $0.14 for some time.

The pair has turned down from $0.26, with fast help at $0.22 after which at $0.21. If the value rebounds off the help zone, it suggests a optimistic sentiment the place dips are being bought. The bulls will then once more attempt to resume the uptrend by pushing the value above $0.26.

Conversely, a drop under $0.21 alerts that the bulls are speeding to the exit. That would pull the value to the 50-day SMA.

Associated: Ethereum to $10K ‘cannot be dominated out’ as ETH worth makes sharp beneficial properties vs. SOL, XRP

Pepe worth prediction

Pepe (PEPE) rallied sharply from the 50-day SMA ($0.000008) and broke above the $0.000011 overhead resistance on Might 8.

The rally has pushed the RSI into the overbought zone, signaling a pullback could also be across the nook. The PEPE/USDT pair might drop to the breakout stage of $0.000011. If the value rebounds off $0.000011, it means that the bulls have flipped the extent into help. That improves the prospects for a rally to $0.000017 after which to $0.000020.

This optimistic view shall be negated within the close to time period if the value turns down and breaks under the 20-day EMA ($0.000009).

The 4-hour chart exhibits that the bears are aggressively defending the $0.000014 stage. That would pull the value right down to the 20-EMA, which is an important stage to keep watch over. If the value rebounds off the 20-EMA, the bulls will make one other try to shove the pair above $0.000014. If they will pull it off, the pair might ascend to $0.000017.

Quite the opposite, a break and shut under the 20-EMA might sink the pair to $0.000011. Consumers are anticipated to defend the $0.000011 stage with all their may as a result of a slide under it might prolong the pullback to the 50-SMA.

Cosmos worth prediction

Cosmos (ATOM) broke out of the big base when it closed above $5.15 on Might 10. That alerts a possible development change.

Nevertheless, the bears are unlikely to surrender simply. They may attempt to pull the value again under the $5.15 stage. In the event that they handle to do this, the aggressive bulls could get trapped, pulling the value to the transferring averages.

Alternatively, if consumers maintain the value above $5.15, the ATOM/USDT pair might decide up momentum and rally to $6.50. Sellers will attempt to halt the up transfer at $6.50, but when the bulls prevail, the pair might rally to $7.50.

The sharp rally has pushed the RSI into the overbought zone on the 4-hour chart, suggesting a short-term correction or consolidation. The bulls must defend the vital $5.15 stage in the event that they wish to preserve the optimistic momentum intact. In the event that they handle to do this, the pair might rally to $6.60.

Contrarily, a break and shut under $5.15 might pull the value right down to the 20-EMA. This is a vital stage to be careful for as a result of a break under it might sink the pair to $4.70.

This text doesn’t comprise funding recommendation or suggestions. Each funding and buying and selling transfer entails threat, and readers ought to conduct their very own analysis when making a call.