Bitcoin (BTC) is now up 3% because the starting of Could, after gaining 14% acquire in April.

Inflows into BTC exchange-traded funds (ETFs) have accelerated over the previous two weeks, whereas constant bitcoin treasury accumulation continues to help the market.

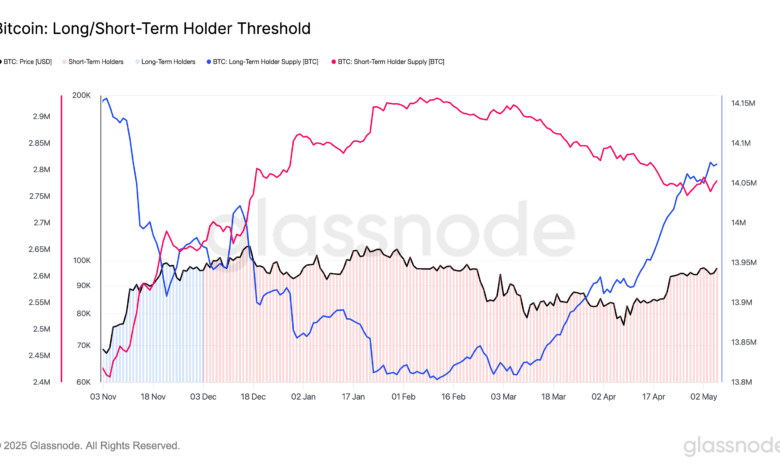

From an on-chain perspective, Glassnode knowledge exhibits that each short-term holders (STHs) and long-term holders (LTHs) have elevated their provide holdings, LTHs since early March, whereas STHs have begun accumulating over the previous week.

Glassnode defines LTHs as buyers who’ve held BTC for 155 days or extra, whereas STHs have held for lower than 155 days. Of their newest weekly report, Glassnode notes that LTHs have elevated their holdings by over 250,000 BTC, because the begin of March, taking the cohort’s complete provide to over 14 million BTC.

“This implies a level of confidence has returned, and accumulation pressures are outweighing the propensity for buyers to spend and de-risk,” in accordance with Glassnode.

Whereas STHs typically act in opposition to LTHs, they too have proven indicators of renewed accumulation, including over 25,000 BTC prior to now week. This marks a reversal from the web distribution of greater than 200,000 BTC that started in February 2025, coinciding with the onset of bitcoin’s 30% drawdown.

With BTC presently flirting with the $97,000 degree, this broad-based accumulation signifies a restoration of confidence throughout investor cohorts. Nevertheless, Glassnode additionally identifies a serious resistance degree at $99,900, the place long-term holders could start to appreciate earnings after they begin to maintain a +350% unrealized revenue margin, in accordance with Glassnode knowledge.

“As such, we are able to anticipate an uptick in sell-side strain because the market approaches this zone, making it an space that may seemingly require substantial buy-side demand to soak up the distribution, and maintain upwards momentum”.

Learn extra: Large Bitcoin Bull Run Forward? Two Chart Patterns Mirror BTC’s Rally to $109K