It’s usually mentioned that crypto is an element expertise and half faith. As such, it’s hardly stunning that the unfolding regulatory overhaul has been accompanied each by vigorous soul looking out associated to the state of crypto’s (usually anti-establishment) core values and palpable pleasure over potential new use instances.

With the blessing of CoinDesk, I requested the panelists of our upcoming individuals’s regulatory roundtable at Consensus 2025—every of them crypto veterans and advocates for wise regulation—about safeguarding crypto values in regulatory reform and in regards to the innovation that new regulation is making attainable.

You possibly can catch Kayvan Sadeghi, Connor Spelliscy, Lewis Cohen, Michelle Ann Gitlitz and David Adlerstein talking on the Individuals’s Regulatory Roundtable on Could 14 at 10 a.m. on the Highlight Stage. The roundtable might be moderated by Ivo Entchev. If you need to submit a query forward of time, please e-mail it to [email protected].

That is what they needed to say.

Which core crypto values are most vital to you and why? How can we be sure that they’re revered by regulatory reform?

KAYVAN: Particular person freedom and sovereignty are core values. Privateness and decentralization are vital largely as a way to reaching that sovereignty, which may in any other case be undermined by way of surveillance and centralized factors of management.

To make sure that these values are revered, it’s useful to reframe the dialog to give attention to the methods through which new expertise can obtain the goals of the present legal guidelines, not simply in a different way, however higher. For instance, many monetary laws are designed to forestall abuse by these with management over different individuals’s property. However so long as people maintain that energy, the chance of corruption and greed will persist and the identical issues will recur.

Closely regulated intermediaries is one path, however eradicating the human intermediaries altogether can remove the basis trigger. By analogy, one can curtail drunk-driving with stricter alcohol legal guidelines and extra frequent roadside checkpoints, however these are band-aids on an issue that may be eradicated with autonomous automobiles.

There might be rising pains as new expertise is battle-tested, and the dangers will look totally different from the dangers of human intermediaries, however the values could be preserved by focusing the dialogue round the usage of expertise to ship higher options to issues that the regulation is already attempting to unravel.

CONNOR: Blockchain expertise can present customers with unprecedented ranges of transparency, reliability, and safety—so long as coverage frameworks enable it to flourish by incentivizing decentralization.

If correctly regulated, blockchain tasks will proceed to decentralize, giving customers higher management over their funds and digital property, lowering reliance on overreaching establishments. Past monetary use instances, decentralized blockchain networks perform as infrastructure for quite a lot of functions that present customers with extra autonomy over their lives, together with, for instance: social media platforms that enable customers to personal and management their information, community-owned platforms that leverage decentralized governance to compete with Huge Tech, and digital id protocols mandatory for customers to guard their id on-line from subtle AI-enabled bots.

We consider that specializing in management is the best framing possibility for outlining decentralization below regulation. Assembly a check for management would considerably cut back info asymmetries stemming from the management of a blockchain’s token, justifying decrease regulatory burdens or exemptions below securities legal guidelines. We advisable particular management ideas to implement in our Designing Blockchain for a Flourishing Business paper we printed this week, incorporating suggestions from 40+ groups, founders, operators, attorneys, and policymakers.

LEWIS: After we discuss core values, I take into consideration the values of these customers and builders who’re interested in the crypto house, fairly than the values of a expertise as such. These people, in my expertise, are attracted by many issues that definitely embrace private sovereignty and decentralization, however are not at all restricted to those options.

What means essentially the most to me and has pushed me ahead for the final 10 years, is working with, and serving the wants of, that extremely various group of customers and builders – fiercely devoted to innovation and growing a brand new “Web of Worth.” We will always remember that, at its coronary heart, “crypto” is a system of instruments constructed from the bottom up, not by massive firms, however by people contributing their time, power, and creativity to assist make the world a extra related and inclusive place.

MICHELLE: Decentralization is a very powerful worth to me as a result of the distribution of energy, management, and decision-making throughout a community fairly than within the palms of central authorities permits true digital possession and freedom to transact. The place there’s centralization and management, we’d like authorized and regulatory safeguards which might be fairly tailor-made to the actual intricacies of the blockchain-based programs. Making certain decentralization is revered requires legislators and regulators to really perceive the underlying infrastructure to allow them to craft guidelines that shield shoppers from lack of funds or worth and to safeguard towards monetary crimes.

DAVID: I’ve been a company lawyer for over 20 years and am an ardent believer in free markets. The idea of acknowledged rights in alienable property, the idea that entrepreneurs ought to be free to check concepts within the market, and the idea of “freedom of contract”—that consenting adults ought to be free to enter into exchanges of products and companies as they want—are all on the coronary heart of U.S. company regulation (and that of different liberal democracies). These ideas are quintessential crypto values.

For all crypto’s novelty, the paradigm of needing cheap regulatory safeguards round a brand new expertise is an outdated one. Industrial airplanes have been as soon as new tech, and for good purpose we have now laws to make sure issues like pilot coaching and security requirements, however as of late you possibly can just about fly anyplace everytime you need to.

The identical paradigm ought to apply right here. I consider it’s attainable for regulators to protect openness to new software-based enterprise fashions and organizational kinds, whereas fairly tailoring safeguards to forestall issues like monetary crises and terror financing.

Is regulation opening the door to new and beneficial enterprise fashions/merchandise?

KAYVAN: Smart regulation may have profound implications for any enterprise pushed by group engagement and community results. Many applied sciences are reducing the barrier for people and small groups to generate and distribute content material in competitors with bigger centralized firms. Efficient regulation can additional empower people by paving the way in which for good actors to have extra direct entry to allocation of capital, and for a broader mainstream viewers to take part within the ecosystem and profit from the community results of the communities through which they take part.

CONNOR: To be decided! We’ve seen much more mainstream and institutional curiosity in blockchain expertise now that it seems the house can have clearer parameters as specified by laws like a market construction and stablecoin invoice however till these payments move, I feel many bold and thrilling blockchain tasks will proceed to have an issue scaling. I’m optimistic we’ll be seeing extra impactful tasks launch in areas like decentralized AI, digital id, and social media. I’d additionally like to see authorized readability for novel organizational buildings like DAOs in order that these varieties of organizations can proceed to experiment and enhance; with respect to DAOs, the newly accessible Wyoming DUNA has confirmed to be an amazing step ahead.

LEWIS: The door is at all times open to innovation! Regulation, when it really works because it ought to, facilitates innovation in a balanced and sustainable method, however is reactive to new enterprise fashions that the group adopts and truly makes use of.

I consider laws of their most supreme kind as much like the event of automotive journey. Innovators developed the auto—“horseless carriages” which initially traveled alongside muddy trails supposed for a really totally different form of transportation. Seeing this innovation, the federal government paved and painted strains on roads. Sure, this constrained drivers to some extent, however it additionally allowed them to journey extra safely and go a lot quicker. It was the non-public sector that took the lead when it got here to vehicle innovation, designing new sorts of automobiles with new applied sciences that journey on these roads.

Regardless of how properly supposed on the time, any regulation that seeks to place its finger on the size and promote one sort of expertise method over one other normally winds up backfiring not directly and distorting the market. Innovators will proceed to create, and regulators ought to proceed to observe over and adapt to those improvements, not lead them.

MICHELLE: I’ve been within the crypto business for the final 10 years and have labored principally in closely regulated areas coping with monetary integrity and client safety. I’ve seen new enterprise fashions and merchandise resembling stablecoins proliferate within the ecosystem within the absence of regulatory readability. Considerate regulation permits wider adoption of progressive crypto merchandise with higher confidence by offering readability to builders and belief amongst customers. I’ve additionally seen extra tasks within the crypto business prioritize compliance in comparison with a decade in the past.

Because of this, there’s a vital alternative for RegTech options to construct compliance tooling and processes. We do that each day at Change Brokers the place we’re on a mission to streamline workflows, cut back prices and unlock efficiencies utilizing our safe AI-powered automation first platform. Conventional monetary establishments usually function on decades-old platforms that weren’t designed to interface with trendy applied sciences. They battle with fragmented information saved in disparate programs and codecs. Jurisdictions keep various approaches to regulation, additional complicating these points.

Crypto platforms inherently facilitate compliance as a result of blockchain expertise permits clear recordkeeping, extra automated compliance checks and immutable audit trails. Crypto platforms are additionally developed with API-first approaches, making integration with RegTech merchandise considerably extra simple. Lastly, crypto firms can oftentimes automate regulatory compliance capabilities instantly from their transaction information fairly than manually aggregating information from a number of programs, growing delays and creating the potential for error. Finally, these components give crypto firms a aggressive edge over TradFi as a result of they’ll higher cut back compliance prices whereas additionally offering extra correct info to regulators.

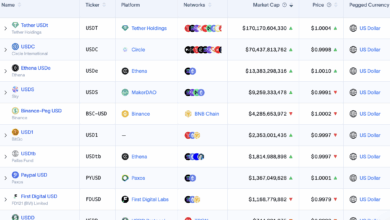

DAVID: There are numerous highly effective narratives inside crypto, starting with Bitcoin as a resilient retailer of worth now over 16 years outdated borderline historical for expertise as of late. However I’m significantly enthusiastic about stablecoins and tokenization of real-world property. The potential influence of getting a nexus between capital and a completely composable, Turing-complete world laptop shouldn’t be extensively understood.

Cash is the very lifeblood of commerce, and issues like instantaneous funds with little friction and the power of the unbanked to make use of digital greenback equivalents, to call simply a few examples, are solely the start. Stablecoins are already pretty widespread, however impending U.S. regulation will open the door to rather more widespread utilization. It’s crucial to get stablecoin regulation proper, with a selected emphasis on minimizing run threat, preserving the power to fight illicit finance, and selling interoperability.