Cardano’s ADA and XRP led losses amongst majors on Tuesday as merchants await the end result of the upcoming Federal Reserve (FOMC) assembly, the place charges are anticipated to remain unchanged however Fed chair Jerome Powell’s feedback may present cues on additional market positioning.

Bitcoin (BTC) costs held above $94,000 after briefly dipping under that degree on Sunday, persevering with its current range-bound conduct.

ADA worth dropped practically 4% whereas XRP slid equally. Ether (ETH) fell practically 1%, BNB Chain’s BNB rose 1.3% and memecoin dogecoin (DOGE) was down 2% prior to now 24 hours.

The broad-based CoinDesk 20 (CD20), a liquid index that tracks the biggest tokens by market capitalization, dropped a little bit over 1.8%.

Elsewhere, some DeFi tokens reminiscent of AAVE, Curve’s CRV, and Hyperliquid’s HYPE have seen a bump in demand over the previous week in an indication of dealer curiosity towards tasks with utility and yield mechanisms, some say.

“As memecoins fall out of favor, merchants are turning to tasks with stronger fundamentals and token economics,” mentioned Kay Lu, CEO of HashKey Eco Labs, instructed CoinDesk in a Telegram message.

“DeFi ecosystems are benefiting from this pivot, particularly as Bitcoin exhibits decreased volatility and macro uncertainty lingers. We’re hopeful to see the DeFi pattern proceed as Bitcoin maintains decreased volatility and crypto acts as a hedge for financial uncertainty,” Lu added.

HYPE led positive aspects among the many prime 100 tokens with a 72% surge prior to now week, with AAVE and CRV up as a lot as 40%.

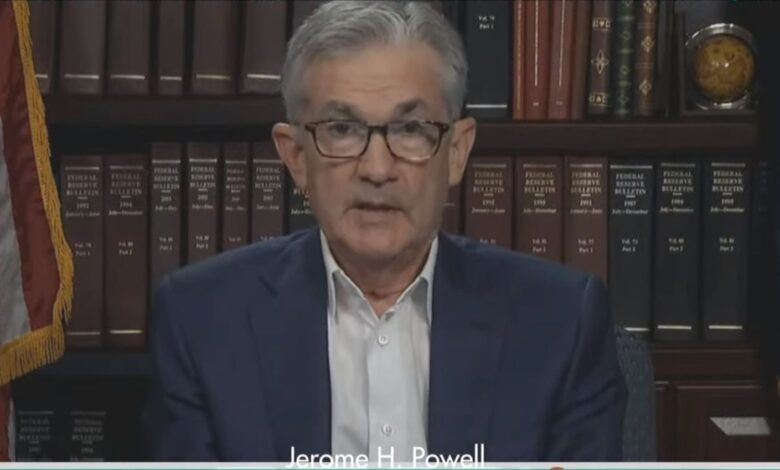

Powell’s remark in focus

Merchants throughout each crypto and conventional finance markets are eyeing this week’s FOMC rate of interest resolution, with consensus expectations pointing to a pause in fee hikes.

Nonetheless, uncertainty round inflation, tariffs, and the broader U.S.–China commerce tensions has left many individuals cautious.

“We don’t count on the FOMC to set off a serious transfer in markets,” mentioned Augustine Fan, Head of Insights at SignalPlus, in a Telegram message. “It’s a coin flip on route. Crypto will seemingly take cues from broader earnings development and the way the economic system digests the impression of current commerce insurance policies.”

Latest inventory market energy means that traders are pricing in solely a light recession danger, round 8%, in keeping with historic drawdown fashions. That contrasts with extra bearish alerts from bond markets and macroeconomic forecasts, Fan added.

Final week, President Trump confirmed no speedy plans for talks with China, dampening hopes for a breakthrough in U.S.–China commerce negotiations. Nonetheless, the potential for separate commerce agreements has helped preserve danger sentiment intact, as reported Monday.