Optimistic US Greenback (USD) sentiment seen up to now in July (which largely displays short-covering demand after the USD’s fast slide within the first half of the 12 months) could also be stalling out, Scotiabank’s Chief FX Strategists Shaun Osborne and Eric Theoret notice.

USD trades typically decrease as bullish sentiment fades

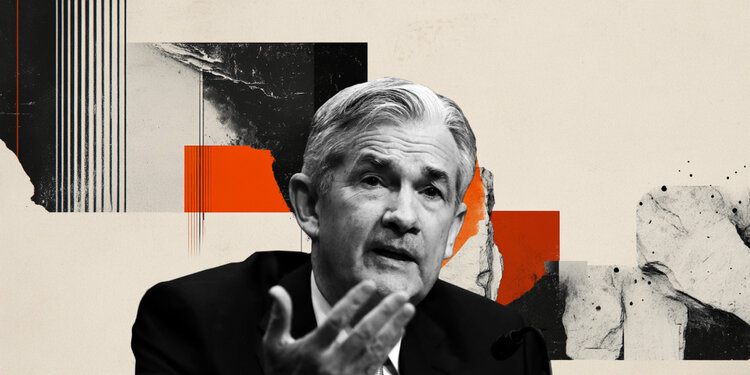

“Within the brief run, feedback from Fed Governor Waller, a recognized dove, calling for decrease charges now, have helped curb the USD into the top of the week although swaps pricing is unmoved (and successfully pricing in zero danger of an ease on the July thirtieth determination). Extra typically although, President Trump’s continued assault on Fed Chair Powell after yesterday’s better-than-expected knowledge could also be weighing extra on USD sentiment. Ramping up criticism of the Fed received’t change a lot within the brief run. Swaps pricing displays some retrenchment in Fed easing bets for 2025 previously couple of months, however extra anticipation of Fed cuts in 2026.”

“That may replicate considerations that tariff uncertainty will preserve the Fed from easing charges a lot this 12 months. However it may also be a manifestation of how markets see the results of a change in Fed management taking part in out—extra aggressive easing subsequent 12 months because the president installs somebody who shares his view on the place charge coverage ought to be. Be aware that the Treasury time period premium has re-widened some 18bps because the begin of July whereas US inflation swaps proceed to replicate expectations of extra inflation 12 and 24 months out. It isn’t a stretch to say that every one this means investor confidence within the Fed’s institutional resilience is weakening whereas confidence in low and secure inflation is eroding because of the assaults on the Fed chair, none of which might be optimistic for the greenback’s outlook.”

“On the day up to now, the NOK and SEK are main positive aspects on the USD whereas the JPY is little modified and a reasonable underperformer. US knowledge releases embody Housing Begins, Constructing Permits and U. Michigan Sentiment knowledge. Inflation expectations could also be a spotlight on this report. On the charts, the DXY’s July advances has slowed within the later a part of this week across the 50-day MA, the place greenback rebounds peaked in Could and June. Intraday value motion is leaning somewhat delicate. A break beneath 98.0 for the index might be a short-term (at the very least) technical destructive.”